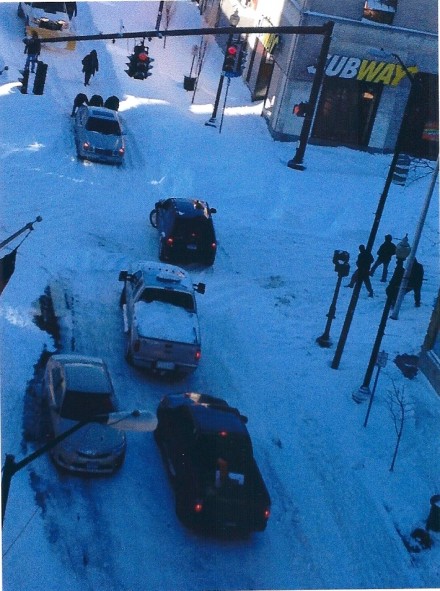

The city was mauled both physically and financially from the blizzard of 2013, and some areas of the city still require attention. Mayor Bill Finch is about five weeks from submitting his budget proposal to the City Council for the year starting July 1 in what is shaping up to be, depending on a number of factors, a nails-against-a-blackboard spending plan. Please pass the chalk. It would be nice if the city knew just how much it will receive in federal storm reimbursement costs as a result of President Obama’s emergency declaration for the state. As bean counters put the final details on a difficult city budget every little bit helps.

The city has calculated, soup to the nuts, that response costs to the storm could be upwards of $1.7 million.

This is a weird budget process for Finch, especially with a Democratic governor and Democratic legislature in Hartford that are supposed to be your friends. It may very well be the legislature will help bail him out, but don’t hold your breath. Malloy’s budget proposal, according to city bean counters, strips roughly $30 million from the city that would normally be expected. More than half of that loss comes in the form of Malloy’s proposal to eliminate taxes on motor vehicles. This is a tax collected by the city that goes into the municipal general fund. Municipal leaders across the state are saying dude, what are you doing to us? Look boys and girls, Malloy counters, it’s really a revenue shift. I’m eliminating taxes on motor vehicles (Translation: my poll numbers suck so I need help) but you can make up the revenue on the property tax side. We all gotta do what we gotta do, yadda, yadda, yadda.

So the governor gets to eliminate a tax, make himself look good, and municipal leaders must explain well, gee, oh, sorry, argh, we had to raise your property taxes to accommodate the governor’s reelection campaign. Malloy’s car-tax elimination plan blows a few tires with the voters he’ll need next year for reelection, the urban dwellers who got him to the dance. As proposed, folks who don’t own cars in Bridgeport, and that represents thousands of citizens, primarily senior citizens, or don’t own property, will see costs rise be it in property taxes or rent increases passed on by landlords.

And what about businesses that will see a tax increase? Bridgeport has one of the highest mil rates in the state. What kind of message is Malloy sending to businesses currently doing business in the city or thinking about relocating there? “Oh, we eliminated car taxes.” What does it matter that the mil rate soared?

It’s disingenuous for Governor Malloy to propose a car-tax elimination when Stamford Mayor Malloy railed against that very same proposal Republican Governor Jodi Rell offered several years ago.

The state legislature is working through Malloy’s budget. Finch is tinkering with his budget based on what the legislature does. Some of what Finch proposes to the City Council in the beginning of April will be a leap of faith.

That’s why every dollar the city can leverage from the feds counts.

Bridgeport is not eligible for full reimbursement of snow-related costs from the federal government because it took too long to clean up. As the top-taxed city in the nation, it’s time for the Mayor and the City Council to get serious. They should be looking for ways to reduce spending, broaden the tax base and minimize tax rates. There is no way Bridgeport should consider raising tax rates again. In addition, Gov. Malloy needs to work more on improving the financial condition and competitive posture of the state rather than posturing for re-election. CT is the worst state in the union for total liabilities and unfunded promises per taxpayer. And if Bridgeport were a state, it would be number 47!

Malloy, like Obama, complains every year we have to tighten our belt but they are increasing spending. This year’s state budget represents an increase in spending over last year. I do not know what he is spending all this money on because he is cutting aid to cities. Obama was on TV last night predicting if we do not increase the debt limit we will have to lay off police and fire (not a federal item), the army, federal employees, close bases and if you do not get on board, those cuts are going to be in your state. How is it that the best and least hurtful cuts are best made in the states that do not support him? We could close bases in Europe. You remember, the ones we built to keep the red menace behind its iron curtain. Well, that curtain is gone. The spending cuts are just 3% of the national budget. If you were a family taking home $1000/month, 3% would be $30, or ~$7/ week. Less that one pack of cigarettes, 2 gallons of gas or 3 sodas. Debt limits do not work if you just raise the limit every time you reach it. These guys need to be more fiscally responsible. What would happen to any of us if we maxed our credit card, then got the limit raised over and over? How long could you live like that? Sooner or later these bills will have to be paid. We would all be better off making that sooner.

The Comeback America Initiative (CAI), which I founded and head and is based in Bridgeport, has teamed up with UCONN’s economic research and analysis team. We will publish a joint report designed to note where we are and how we compare to other states. It will also outline some things that need to be done to put the state’s finances in order and improve its competitive posture. The report will be issued this spring. The truth is, California has already passed a tipping point and Connecticut is close to passing one. We must change course very soon.

Because people like yourself who are well off don’t think they have to pay taxes. No one asked you to move here, Walker.

*** Come on BRG, let’s be civil, no? I for one welcome D.W. to Bpt. and his interest and inputs concerning this city’s financial woes. The more level-headed citizens who are willing to get involved in crying wolf when they actually see one, the better! Between the Republicans and Independents in this city a pack must be formed together towards gaining some political clout district by district. With citizen’s teamwork and public awareness towards the voting masses, it’s possible to put a dent in the machine. Political awareness by any public means available is needed. *** EXTRA, EXTRA, READ ALL ABOUT IT! ***

You obviously don’t know me personally even though you allegedly live in Black Rock. In reality, many Bridgeport residents asked me to move here when they heard I would consider it. Many non-Bridgeport residents encouraged me to move elsewhere, including their own towns.

And BTW Mr. Walker I have lived here for three decades, far longer than you have and I actually know about this city … which is more than the people who hang out at Harborveiw market.

David, you are pretty much the only sound voice I ever read on this site. You make so much sense I fear it will fall on dead ears because nothing in this city seems to run on any soundness. Can the citizens refuse to pay taxes in protest? What can we do? I for one am trapped in a house that has lost so much value and a city in such a state of TERRIBLE PR it’s virtually unsellable unless I agree to lose everything–walk away–to leave. This is despicable that the people of this city are forced into a corner like this and it seems to me it should be illegal. We are already assessed on old figures that weren’t even realistic then, and don’t reflect the upwards of 50% depreciation the market has been in for years. What can we do as citizens to say NO WAY ANYMORE. We aren’t paying for your bad management anymore. What can we really do to do this?

If you have lived in Bridgeport for 30 years then you should know the City has serious governance, education, finance, economic development and tax challenges. I am trying to do something about them. Are you?

BRG: Then you should know what has happened to the city over the last 30 years. They say BPT has good bones. You know that is true because you can see them. Like the bones you can see on a deer that has been left on the side of the highway for too long. The only city leaders we have left are the buzzards looking to strip the last of what is left.

Good job, DW.

I hate the idea of paying MORE in property tax, but I LOVE the idea of eliminating the vehicle tax. It’s an extra, unnecessary burden on many low-income families. The DMV uses it to hold many poor hostage since the tax is linked to vehicle registration requirements.

Moreover ANYTIME there is a proposal to eliminate a tax we should embrace the possibilities that come with it, even if there is a shift in the burden.

You can only push so much onto the homeowners. The new tax that will be added to the homeowners will be high plus you can expect a tax increase because of city mismanagement of tax money they receive. Don’t forget the homeowner is subject to the same DMV tactics the poor encounter.

While I am in favor of helping the poor with the necessities of life, enough is enough. Now there is a bill to provide food stamps to pets. Check it out.

Andrew, do your research. That is not a bill. It’s a privately funded and executed program. You do no one any justice to raise ire over issues you have only heard about third party. READ UP.

Brick–They are not shifting or eliminating anything. Let’s look at what may happen. All the poor people car taxes get shifted to my rental apartments. Except for the guy who bought his new BMW that is worth more than $28K. He still needs to pay car taxes. Since I am not running a charity, I am going to raise my rents. The only people who will really make out are those who live in public housing since their rent is not tied to any real economics. The only thing that will be saved is the welfare money they get and those who are trying to get out of the projects will be more trapped because of the increase in rents. Renters will be less able to buy a house because of the higher property tax. Everybody is going to make up the tax shift if they can. Businesses will make it up through higher prices or lower pay. If folks can afford it (rich or retired), they will move. The ‘shift’ will be left to the middle class and working poor through higher retail prices, rents and property taxes.

I agree 100% the result of eliminating the car tax will result in increased costs in the form of higher rent and property tax.

However I think we can all agree eliminating the car tax should be done. The only question is how to avoid having the burden shift to homeowners. Personally I think Bpt is overpopulated, underfunded (especially the P.I.L.O.T. Program) and economically isolated because our neighboring towns have subverted nearly all attempts to allow affordable housing.

Elimination of the car tax IS a good thing, it’s just we need better ways to offset the costs.

I do not agree at all. My car tax is $46 because I have been driving the same hooptie forever. We are just getting rooked. The AmeriCANs get screwed because they CAN make us pay and the AmeriCANTs get over. I agree you should pay your taxes and I should pay mine. Two things about shifting the car tax. Houses get more valuable and cars lose value, quickly. Once they raise the mil rate it is never going back down. But the car I used to pay on is now worth nothing and the house I am currently paying on is more valuable. House taxes are unrecoverable. At some time in the future, I hope to sell my house for what I paid for it plus the mortgage interest and then some. The taxes I paid will never get recovered and high taxes negatively affect my houses value. If my taxes are high the house is worth less because the new buyer has to work that payment into the money they have budgeted for buying the place. A high tax payment leaves less for them to pay for principal and interest. Also, with so many people already losing their houses adding another bill will not help that. I may have sold my car to keep my house. Now, I have to pay your car taxes. How is that fair?

Bpt does not have affordable housing. That is just a myth. Look at the following example. If you bought a $175K house in BPT you would pay $600/mo taxes, $1000 private school, $1102 Principal & Interest for a total of $2700/mo. That would buy you a $320K house in Fairfield, assuming $623 taxes, $2129 P&I and the Fairfield schools are acceptable to you. This would also be a total of 2750/mo. I’m going to guess insurance is the same in both cities even though your car insurance will drop in half when you move out of BPT. What will you get when you sell your BPT vs. your Fairfield house? People who think BPT is affordable based only on house prices are being shortsighted.

Will sanity prevail on behalf of taxpayers? Let us be realistic here, without a complete cultural change at city hall it will not. Taxpayers need a government that knows how to be more productive and efficient. Something most organizations had to do in order to survive the last few years. Let us hope our political leaders know what it means to be productive and efficient.

Is the city of Bridgeport bankrupt? A city council person says yes.

www .ctpost.com/local/article/City-Council-borrows-110M-to-pay-bills-4307885.php

The newspaper’s paper edition says “Definition of Broke Debated.” Is it possible the city is already bankrupt yet just didn’t declare bankruptcy? How far can tax anticipation notes cover it?

What are bankruptcy possible consequences … When declaring bankruptcy, do existing union pay agreements become null, void and renegotiable? If so unions could lose benefits and pay, so going bankrupt is bad for unions then.

Efforts to save money in the city should be supported by the unions and their leaders. And if there were a bill on the table to save money, such as the one removing conflict of interest, then the unions would support that bill, right? Just the opposite.

The union leaders have come out strongly against the conflict of interest bill and some say they are now the biggest obstacles to passing it. Could union leaders be acting against the interests of their own union members?

This is serious stuff though really at this point. Urgent situation not only financially but with funds for city extreme weather responses.

Lennie, are you really buying into Malloy’s proposal to eliminate taxes on motor vehicles?

Malloy already put his foot in his mouth by stating he is opposed to bringing back the tolls to Connecticut highways. Watch Malloy go along with the toll plan and blame those who opposed his plan to eliminate taxes on motor vehicles. We will be paying more taxes in the form of highway tolls.

Out of all the political contributors to Dan Malloy, are there any who own or are tied to owners of new car dealerships or businesses who own large fleets of vehicles?

Speedy, you may be right; he could be looking for someone to blame and that be the legislature.

Governor Rell’s car tax proposal was far better than the Trojan horse offered by Governor Malloy. Her plan at least attempted to reimburse cities and towns for the revenue loss.

*** City cash on hand “no,” ability to still borrow money to pay bills at a reasonable interest rate “yes!” However how long can the city continue to borrow from Paul, to keep paying Peter? Solution on an off election year for the Mayor however throwing the city council members under the bus; make cuts and raise taxes on anything and everything in the city, no? Along with State tax raises and cuts by Malloy this is bound to be a year not worth remembering in general! *** GOD HELP US, EVERYONE! ***

stevenl,

Enough is enough! It’s time to take on the political machine and various special interests. We need more truth, transparency, accountability and transformation in government. We also need to elect people who are committed to real governance, financial, education and other reforms both in Bridgeport and at the state level. More immediately, we need to pass HR 5724, pursue a comprehensive Charter revision, and gain state appointment of a Financial Control Board for Bridgeport. I’m committed to doing my part and a growing number of people are joining the cause. Hopefully you will too.

Dave