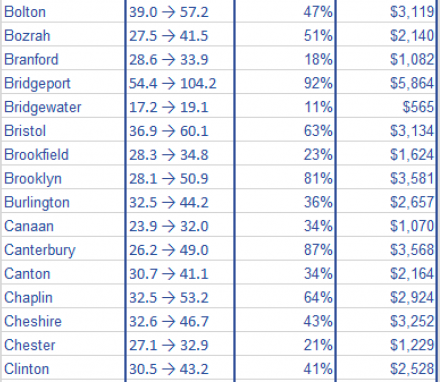

The Beatles’ Revolver album features the George Harrison gem Taxman. Let me tell you how it will be … There’s one for you, nineteen for me … ‘Cause I’m the taxman, yeah, I’m the taxman. If Republican Bob Stefanowski has his way as governor property taxes in Bridgeport would jump $5,864, according to his Democratic opponent Ned Lamont who has released a town-by-town chart based on Stefanowski’s pledge to phase out the personal income tax, over eight years, that accounts for more than 50 percent of state revenues that find their way to local municipalities. See chart here. Stefanowski hasn’t identified clearly how the state will make up for the multi-billion revenue shortfall, relying on the traditional Republican mantra that spending cuts lead to more private investment and therefore more tax revenue.

In filleting Stefanowski on his fantastical budget pledge, Lamont is appealing to voters on a local basis showing the tax impact on every Connecticut municipality. The Republican playbook generally frames the Democrat as the big-spending boogeyman of taxes. Lamont is trying to capture a tax message that defines Stefanowski before he defines Lamont as voters begin to focus post Labor Day.

Lamont asserts all Connecticut municipalities would experience deep cuts in state aid with cities hardest hit. “In New Haven, property taxes would increase by 116 percent and the median extra tax bill would be $6,669. In the state’s largest city, Bridgeport, taxpayers would see their property taxes increase by 92 percent and would have to pay $5,864 more each year.”

Since the August 14 primary, the largely unknown Stefanowski, a former financial services executive, has been relatively quiet on the public campaign trail spending much of his time dialing for dollars after spending a few million of his own dough to defeat four other GOP challengers. Inspiring respective party turnout is key but in Connecticut the larger bloc of unaffiliated voters swing statewide races, electors Lamont is trying to woo ahead of Stefanowski.

From Lamont:

This November, voters across Connecticut will again have a choice in determining the future of this state. We’ve fallen behind and now more than ever, it’s crucial to elect a governor with a vision and plan to build a 21st century economy for our state. To do that, we must reduce the property tax burden felt by so many working families, invest in our children’s future, attract more jobs and build an efficient transportation system.

I believe in Connecticut and in our future, and I believe we can create a vibrant economy with smart tax cuts, strategic investments and doubling down on the priorities that make Connecticut a great place to call home.

If Republicans are allowed to follow through on their radical promises, they would create an additional $11 billion hole in the state’s already strained $18 billion budget, causing property taxes in every one of Connecticut’s 169 towns to increase–in some, by well over 100 percent.

Those increases in property tax would only keep municipalities at current levels. It would prevent further investments in local education and other town and city services, a devastating result considering many schools throughout our state are already underfunded.

Connecticut’s income taxes account for 61 percent of the revenue in our general fund. Without a new source of revenue, every line item in the budget would have to be cut in half or eliminated entirely. The bulk of these cuts would fall on our middle-class families and the towns in which they live.

State aid represents at least 27 percent of local government revenue–and that’s before the state’s heavy obligations for teacher pensions are taken into account. It represents 40 percent of our education budget.

If our towns had to stand on their own, then the state’s largest cities, already cash-strapped, would be hit the hardest. In New Haven, property taxes would increase by 116 percent and the median extra tax bill would be $6,669. In the state’s largest city, Bridgeport, taxpayers would see their property taxes increase by 92 percent and would have to pay $5,864 more each year. Small towns and suburbs would get hit, too. In Coventry, property taxes would go up by 57 percent, an extra $3,242 per year. And in Derby, the property tax hike would be 68 percent–a hit of $3,764.

For Connecticut to regain its standing as a place where people want to live, work and raise a family, we need to make our state a place where people can afford to live again.

Voters have a choice this November: to maintain the status quo or revitalize and strengthen our urban centers to be the economic engines that drive our state toward future success.

I believe in building a Connecticut for the 21st century. To do that, we need to enhance the vibrancy of our towns and cities by investing in education and our transportation infrastructure, so we can attract new businesses and residents to the region as we create more jobs.

As governor, I would do what I did as a successful entrepreneur and executive: stretch dollars, eliminate inefficiencies, leverage new technologies and bring stakeholders to the table to decrease costs.

Last week, I unveiled a realistic proposal to cut property taxes for the middle class. The budget has been balanced on the backs of the middle class for too long, and working families are struggling. My proposal targeted to the middle class would give the average beneficiary nearly $700 more in their wallets annually. It’s a smart step that reverses a Gov. Malloy tax increase.

Republican nominee Bob Stefanowski’s plan to create an $11 billion hole would eliminate funds for economic development programs, our state colleges and universities, public safety, environmental protection, job training and healthcare for one in every five residents.

Unless Stefanowski plans to default on our debts, quadruple sales taxes to more than 25 percent, or simply begin printing money, what’s left in the general fund will be taken up by the state’s fixed obligations. There will be nothing left for our towns.

The following chart, based on the most recent property tax and intergovernmental revenues, shows what would happen to property rates if Stefanowski’s radical plan becomes reality.

The impact of Stefanowski’s tax plan would be felt across our state by all our residents, either by massive tax increases or extraordinary cuts to priorities like education.

He is making the same kind of dishonest campaign promises that got our state into a fiscal mess in the first place, and I believe we need to change how we do business in Connecticut to get our state back on the right track.

My bold, new vision for the state puts residents at the forefront and creates equal opportunities for all Connecticut residents, while steadying the state’s financial footing.

I disagree with Lamont’s reasoning and logic. He leaves fixed obligations untouched. If it’s off the table, it’s removed from the solution process.

If fixed obligations became unfixed, taxes in all 169 municipalities could be reduced and the income tax eliminated!

I am unconvinced Lamont can do what Malloy never did.

What is Bob Stefanowski’s tax plan?

Can you please explain how “fixed obligations” become “unfixed obligation)? Anyway,something that is “unfixed” no longer is an obligation.

Does anyone know about last night’s CC meeting and whether Dan Roach was reappointed to the Board of Police Commusioners?

Ok. I found out. He was reappointed by a vote of 12 to 7. Now I have to find out who voted which way.

Ok. I found out. CC reps Karen Jackson,Kyle Langan,Ernest Newton,Maria Ines Villanueva-Valle,Maria Zambrano Viggiano,Christine Smith,Pete Spain voted against reappointment of Dan Roach. The rest voted for but I will not list them. Since the total was 19, either someone was absent or abstained. I think that Marcus Brown(D-132) would have voted against it. IMHO,I think if the votes weren’t there,the re nomination would have been pulled.

Wow. Marcus Brown did vote yes. Mary McBride Lee was absent.

Btw,Steven Auerbach and I settled the”Senator Moore sweatshirt saga” so all is good there.

Thanks Frank for the names, I think that it’s more important to know who is still supporting the old tired ways of Joe Ganim and Mario Testa and who these soldiers are and why they need to be primary.

I did not write the names of who voted yes. I’ll try to do that later when I have time.

It is curious why Stefanowski has been so quiet.

Frank, Stefanowski is waiting for his talking point from Sean Hannity, Steve Bannon and President 45.

Stefanowski met with top CT Republicans(Chair J.R.Romano et al) right after his primary win and Stefanowski has been quiet since then. I do so see some internet ads.

I do see some internet ads*

Heyyyyy… J.R.Romano…Where are you???.. You’re latest strategy was “Who lost GE?” I don’t think J.R. will make a comment on OIB. He has bigger things to attend to.

And J.R. tends to be loquacious. He is really quiet now.

And if the Republicans lose the gubernatorial race…maybe it will be time to replace J.R. Romano as head of the CT Republican Party.Maybe he is a little worried about that????

Who writes Lamont’s speeches?

Stefanowski never had a plan to create an $11 Billion hole in the budget.

And when running for Governor, the state tax burden is more important than local property taxes. Stick to the knitting.

But here’s the worst part: when Lamont credits Stefanowski with “the kind of mistakes that got Connecticut into this fiscal mess”, he’s trying to transfer our problems to a political newcomer. What’s up with that?

Take it from Local Eyes, Lamont’s tired and timid vision upholds the status quo and reduces opportunities while ignoring the state’s fiscal footing.

What is Bob Stefanowski plan?

Bob Woodward

Where in the World Is Bob Stefanowski?

https://www.youtube.com/watch?v=NgWWube0M1c

Stefanowski Tax Plan — Same as Reagan, only without the benefit of the Federal Money-Printing Machine to finance the tax breaks for the wealthy… Translation — Tax breaks for the wealthy financed by implementing Mississippi-style austerity for a collapsing Connecticut government dealing with a collapsing economy…

Lamont Tax Plan — Make empty promises and finance them by breaking same while making sure to maintain Gold Coast development primacy and commuting-workforce access to service the latter… Just like Gold Coast Dan…

Six of one, or a half-dozen of the other…

Either way, especially for urban dwellers, things are only going to get worse under the next governor. NOT WORTH VOTING THIS YEAR… Send a message. Vote with your seats on November 6…

Stefanowski’s candidacy was doomed the moment he gave Donald Trump an A+ rating.

This is the policy of OIB as stated in info about the site.

Although you are required to provide a valid e-mail address when you register your name, your address will be kept private unless otherwise obligated by law. In addition, the site will not protect you if you make libelous assertions, outrageous allegations or accuse someone of criminal conduct without credible proof. If you think you have proof of illegal conduct go to the authorities. You can criticize, you can express a passionate opinion, but do not attempt to soil a reputation through lies and hate. OIB has the right to edit, reject or ban comments and posters from the site. OIB will approve your very first entry. After that your posts will appear immediately.

On August 23, 2013, we implemented a new policy regarding registration. We will no longer ordinarily allow the registration of an anonymous handle, but we will make an exception if we think you have a good reason. If you want an exception made (for example, you might be a city employee), call or e-mail Lennie and make your case, but in no event will we approve any handle request without knowing who you are. We will not reveal your identity except as provided in our site use policy.

Any reading and analysis shows that stevenl crossed the line.