Citizen fiscal watchdog John Marshall Lee addressed the City Council Monday night, offering a question: “If you were giving yourself a report card today, what grade might you assign to your behavior and accomplishment?” From Lee:

Tonight we meet on the eve of Election Day, of special importance to those running for State Office. Three hundred and sixty four days from now we will be on the eve of another election that will elect candidates for Council and Mayor. Some of you have been through the process multiple times while others were newly elected last year.

It may be difficult to focus on local issues with the entire hoopla attendant to and the dollars spent for Election Day 2014, but I thought I might share a viewpoint with you from the Sunday paper. At the end of an article about one of your long-time members the CT Post quoted a union official who declined to be identified: “The city employees I’ve spoken to think that nothing’s going to happen–that there will be no discipline. A council person should be held to a higher standard, almost like a police officer. Yes, they’re human beings but they should be held to a higher standard.”

I, too, believe in that higher standard of delivery expected of you by following “best practices.” That is why I have been addressing you for several years so that you may become more aware of City business, especially fiscal business using taxpayer dollars, where I sense your attention is not regularly focused or informed. Those are not easy words for you to hear, I have been told. Some of you may have turned off my comments because it is unpleasant to be found wanting and hear that stated. However, if you are correct and the issues I bring to your attention are not true or accurate, I would have expected you to let me know my error. I would be happy to apologize. Please have the courtesy to tell me that. Surely you are not fearful of telling me the truth as you know it, are you?

But here is a union official, perhaps fearful of reprisal for stating his opinion in public, and he is saying what most in the City expect. As our representatives you are held to a higher standard. That standard would suggest that you be more informed when you make decisions, especially decisions that have fiscal importance and bind the City to a course of action for decades into the future. With higher expectations you need credible support to assist you in your deliberative work. That can take the form of staffing of your legislative body. You officially have no support today. It might take the form of simplified 20-page financial reports monthly where variances show clearly. It might be in the form of a formal recommendation for each Committee report to the Council recommending an action and posting to the Consent Calendar have a short summary of the why, how, what, of the motion as well as any and all costs in terms of funds and other resources. Such a summary would be an acknowledgement that your vote had substance rather than it was part of “going along to get along.”

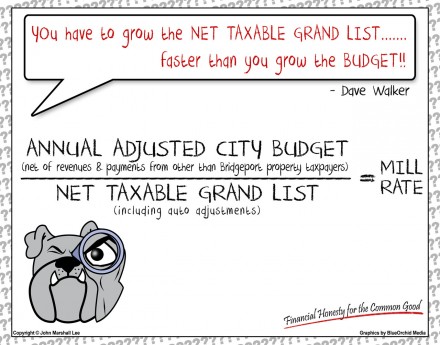

In that regard I have a visual to show you the actions that determine the Mil Rate annually. The numerator of the fraction is derived from the Annual Budget you approve and indicates the net amount of revenues the City needs after estimating all other sources. The denominator of the fraction is represented by all of the properties that have no exclusion, exemption, or special abatement from full taxation. In that regard you have been tearing down the City Net Grand List this fall, as surely as if you were demolishing a building, in the name of “economic development.” You do not indicate what that development will look like when it appears, how long it will take to appear, and what is the full cost to the taxpayer. Is that fair? Where is the list of ALL City Property that has such special treatment? Is it readily available to you? Must a taxpayer search through Freedom of Information for such?

You are special people in Bridgeport. You have duties and responsibilities to the broad public as well as to your district. If you were giving yourself a report card today, what grade might you assign to your behavior and accomplishment? How will you grade the Council’s use of your Legislative budget for $30,000 of secret donations to charity by 15 of the 20 members? The public is looking. The public is paying taxes. What do they see when they are aroused and come to vote? Time will tell.

It is likely this may be the only comment entered on this article. From my viewpoint that is unfortunate in terms of understanding readership on OIB. I prepared this paper on Monday for presentation to the City Council during the public speaking session at 6:30 PM November 3.

Does that mean nobody is concerned about taxes and how they are fairly appraised, assessed and multiplied times the Mil Rate?

In that regard I did get an offline comment from Ray Fusci who is always helpful, technologically for sure. He noted the spelling of ‘Mil Rate’ in my article (he corrected) as well as the poster were wrong. Of course I have seen both spellings used by the City of Bridgeport in their documents. Currently page 38 of the 2014-15 City Adopted Budget uses the term ‘Mill Rate’ where it is used 15 times while the term ‘mils’ is used twice and once on the previous page. I went back to a 2007-08 budget book where the word ‘mills’ is also used and the rate is referred to as the “Tax Rate.”

The current budget book covers Mill Rate (sic) in their Glossary on page 478 with a definition that was not provided in 2007-08.

Of course the real issue is understanding how the Mil Rate is calculated as well as who controls the Budget, as well as activity affecting the Net Taxable Grand List rather than pointing out how many times or for how many years this subject has been wrongly communicated. That is the darkness I was attempting to shine a light upon.

In that regard, the TAX RATE DETERMINATION chart in the current book continues an error of recent vintage in highlighting THE AMOUNT TO BE RAISED as close to $6,877,872,000. Yes, that’s BILLION. It is testimony to the fact no matter how many awards and certificates the City receives for publishing a report, who bothers to read it for understanding and meaning or bothers with proofreading? (The chart labeling is seriously wrong!)

On the previous page just above a chart showing the past ten-year rate history are two paragraphs worth understanding. The final one concludes: “A city-wide assessment of real properties is conducted to assign fair market values to all properties. The assessment allows a balancing of the city’s real property tax burden among taxpayers.”

If land valuation process in the City allows for “land banking” that encourages low valuation of vacant property, if the Mayor’s office has been able to untrack the 2013 posting of reassessments even though the reappraisal was completed and paid for by taxpayers to the tune of $300,000, and the decrease in residential values has caused decrease in personal wealth in the City, how can any taxpayer believe the October 1, 2008 revaluation represents “equalized assessed values in the City of Bridgeport?” That is a serious matter. Does anyone reading OIB care about that issue? Time will tell.