Last month bean counters from H&R Block declared Bridgeport suffers from the highest tax burden in the country. How do these folks calculate this stuff and is it real? Mayor Bill Finch cried foul, saying the blockheads did not include all the variables to reach such an excessive conclusion.

OIB asked Ben Barnes, secretary of the State Office of Policy and Management (state budget director) how the state measures tax burden among its municipalities. Barnes, who occasionally shares his financial wisdom with posts on OIB, asked Dave LeVasseur, his financial undersecretary, to respond.

While there is no one single measure of tax burden among Connecticut’s municipalities, one measure that we capture in our Municipal Fiscal Indicators (which you can find on-line on the OPM website) is the Equalized Mil Rate. It is computed by taking each municipality’s Equalized Net Grand List and the adjusted tax levy.

LeVasseur attached a chart from “our 2011 Fiscal Indicators.” See the top five below from the 168 towns and cities listed.

1 HARTFORD

2 WATERBURY

3 NEW HAVEN

4 BRIDGEPORT

5 WEST HARTFORD

We then asked David Walker, a Bridgeport resident who served as United States Comptroller General from 1998 to 2008, for his take on calculating tax burden. His response:

The best way to compare effective property tax burdens is by determining the percentage of the actual property tax as compared with the full fair market value of the property. This takes the gaming out and Bridgeport and many other CT cities are outrageous on that basis … CT is the “Land of Disparities.” The state must step up and address education, taxation and other major disparities in the absence of county governments.

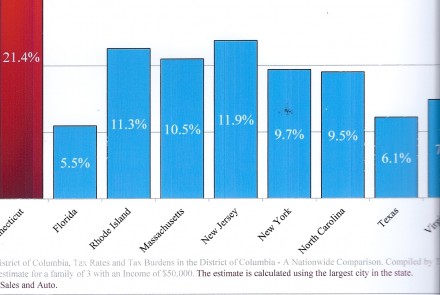

Walker provided the chart included above that he illustrates during his speaking engagements around the country in the cause of pointing out growing tax burdens. “The CT figures relate to Bridgeport,” he says. “The other state figures are based on total state and local tax burden for the largest city in the respective state.”

Okay, taxes are high in Connecticut cities. Is this really about Bridgeport, or more about Connecticut’s taxing policies owning the highest tax burden in the country and how it distributes municipal aid? Is this the result of the Democratic-controlled legislature spending and spending and spending after repeatedly raising taxes? In Connecticut we have property taxes, car taxes, sales taxes, gas taxes, business taxes. How’s your wallet?

Governor Dan Malloy wants to eliminate taxes on motor vehicles without holding municipalities harmless for the revenue loss. Municipal elected officials are lobbying state legislators to put the brakes on Malloy’s proposal.

Here what was published?

Income: $50,000

Property: $10,256

Problem: How does one buy a house in Bridgeport with a household income of $50k and pay $10k in property taxes, the value of that home would be around 400k and your mortgage would be $1600 per month if you put 20% down. Let see you start with $50k – $10k for property taxes = $40k – $19.2k for mortgage payments for the year = $20.8k to pay income taxes, insurance, car, food and any other living expenses a family of three would have. I think H&R Block is full of a lot of BS.

The house I used for the above example is on Seabright Street in Black Rock.

I believe Block was using averages. The house price was a combination of very low-valued houses on the East Side and the very expensive houses on Sailor Lane. Same with the incomes. Lots of poor, some middle class and a few rich. Obviously the average house is not occupied by the average income person. Lots of the average income people live in apartments. I am sure P.T. Barnum apartments brings that average income down, while those apartments do not calculate into that average house price. The three-family walk-ups having three $50k families in them while the house is worth $275K would be about right.

Block was using averages but that is not the key point. No matter how you measure it, Bridgeport’s effective property tax burden is outrageous. It’s time to hold the line on any property tax increases. We need to restructure the City’s finances and promote development for taxpaying entities so the effective property tax rate can decline over time. Anyone who proposes or votes for an increase of the total effective property tax rate should be defeated. They are part of the problem rather than part of the solution.

More drivel from our self-appointed “savior.” Walker will ask our city employees and the poor to bear the austerity he wants … people like Walker are good at asking our mostly hard-working civil service employees and who those have fallen on hard times to make sacrifices and “feel pain” yet are unwilling to do the same.

BRG–Some problems with that. First, Walker did not make the problem we have. Your unions, fellow employees and city government did. The unions allowed the city to promise ’empty hat’ benefits from money that did not exist to secure the futures of the employees. Too many of your union buddies were robbing and raping the system with the OT and just digging the hole deeper. Look at how many times you hear about retired city employees making as much as, if not more, than they made working. Then the city leaders did not fund the systems they promised would be there for the future.

Regardless of who made the problem it is going to bite us in the future. By a new law cities can render union contracts null and void if they go bankrupt. It is just a matter of time. It is going to hurt to fix this and it will not hurt less if we wait. It may not hurt YOU if we wait but it will hurt someone.

Just because Dave is pointing the problem out, do not shoot the messenger. I am sure he pays a boat load, just like everybody else who lives in BPT does. And honestly, if I were him, I would move out. Leave you to stew in your own juices. This really is not his problem. He did not make it, it will not affect him and he can move away from it. Why he wants to help out with it is a mystery but that is good for us. You should keep it up with the criticism and derogatory comments. That will encourage people to help.

BTW: What do you think we should do?

Furthermore Mr. Walker can easily afford his taxes so I find it hard to feel he is making some great sacrifice …

Good for him. He must have made good choices or got lucky growing up. Who suggested Mr. Walker should make a sacrifice? I suggest he bail out and live peacefully somewhere else. He is the one who wants to help out with the problem. What DW can afford is not our concern. He got what he got because of what he did for himself. You could probably easily afford to pay my water bill but why should you? I may be heavy but I sure as hell am not your brother. We are a capitalist country not a socialist one (yet).

BlackRockGuy,

No one likes to be ripped off and the taxpayers of Bridgeport, including me, are being ripped off in connection with high taxes, poor services an unacceptable governance practices. The clock is ticking on this city’s finances and future. It’s time to stand up and change things before it’s too late.

BRG, take your meds. You’ve started confusing our mayor with Dave Walker. For too long we’ve been entertained by your “drivel” on the CT Post and here. How about letting others provide some input? The guys on the CT Post blog have been wondering where you’ve been. Take a Walker over to the CT Post blog and save their day.

You are full of bull. I was a federal public servant for 15 years and have spent the last 5 years of my life in the non-profit sector doing public service.

BlackRockGuy,

I apologize for the “you are full of bull” statement. However, please do your homework in the future if you are going to attack people.

Use any method you like … I paid $2500/year in property tax for a 500 sq. ft. condo apartment in the Embassy Towers. There was no lawn to mow or walk to shovel. Additionally, there was about $300/month in common charges. So that studio cost me about $6000/year.

If that isn’t usury, what is?

I cannot understand BlackRockGuy’s attitude. It’s not a question of asking City employees to bear the brunt … it’s about being realistic.

I don’t know Walker but I’ve seen him on CNBC and elsewhere. Unfortunately for the mentally challenged like BRG, 2 + 2 still = 4.

The numbers do not work. Change must be had!

Most police and fire put not only their lives but often their health on the line … the majority deserve every penny they get.

The city needs to do things like this. No more government subsidized low-income housing. You can already buy a house in BPT for $30K. How much more low-income do you need? The thing that makes housing unaffordable is the taxes, not the house price. Let whoever is willing build houses that will sell for whatever the market will bear.

Sell city-owned properties at auction for whatever someone will pay. If you get $1 that is $1 more than you had and the property will now bring in taxes. Do not wait to put together some grand scheme for the future. Get your money now and let the market dictate how the land is used. If the city owns a lot between two other houses, offer half the lot to each of the neighboring home owners. Cutting down the number of houses in town will increase the value of each house. Plus people can put in garages, parking, have a yard. It will make nice neighborhoods with somewhere for kids to play.

City employee pensions should be calculated on the base pay only. OT will no longer be calculated into the pension. However, employees can designate a set amount of any overtime they make to be deferred into their 357 or 403b retirement plan. I may want half of anything I make in OT put into my 357. That way my income taxes do not hike too much, I get a little extra in my pocket and I put a little away.

Retirees get the same health insurance deal the workers get. A larger pool of insured makes the plan cheaper for everybody and the city can better control of insurance costs.

Build the tax base. That will get easier and easier as property taxes fall. Get the city budget under control. People in town are going to have to start doing for themselves as best they can, even if those are the people who vote you into office. It may be more attractive to put this burden on the rich but they will just move out. Then the middle class will leave. If we do not make a sustainable, balanced system those of us who are left at the end will face ruin.

BOE SPY let me correct you on one thing. City employee retirement pensions are based on your base pay and do NOT include overtime.

The city negotiated a new pension plan for firefighters and soon the police that does have the last best 3 years as part of the retirement benefits however these pensions are now part of the state system and not the city system.

Retirees do not get the same medical coverage as active city employees.

I am not familiar with all the city unions. I was talking about BOE unions. They get 2% * the number of years worked * an average of their best 3 years. They have changed it so the retirees get the same health insurance the workers do.

“The unions allowed the city to promise ’empty hat’ benefits from money that did not exist to secure the futures of the employees. Too many of your union buddies were robbing and raping the system with the OT and just digging the hole deeper.”

The Union “allowed” the City? You don’t hold the Mayor responsible???

“Robbing” by workin OT? Raping by “working?”

Workers don’t really rob, or rape, they work.

Sheesh … just shut up.

What about the supervisors and chief who don’t do any actual work? What about making up your own OT? What about a supervisor assigning himself and a worker to manage a sporting event everyone knows only a dozen people will show up for? I’m just saying, if the money were coming out of their pocket I bet I could have gotten it done a lot cheaper or during regular working hours.

Yes, the unions allowed it. They could have put it in the contract the city must maintain an account with some amount of money in it to pay for this program. This is common in other business transactions. When the city hires contractors they pay half up front and the rest is in an escrow account. The contractor does not take the city at its word they will have the money at the end of the job. I do not hold the mayor responsible because the mayor who made the deal may not be the mayor anymore and it was not the mayor’s fiduciary responsibility to ensure the membership does not get screwed. It should have been obvious to the union a long time ago the pensions and retiree health care was in trouble. The city has been saying it for years. Yet the unions put nothing in the contracts to ensure the city did something to fix it. They may have wanted to do that when they were giving up pay and benefits for today to avoid losing retirement benefits. This was the deal. You give up 10 furlough days, no raises for 3 years and you pay 50% of the insurance premium. You get no layoffs and this empty hat. But when you retire, the hat will be full of money. You would not want the hat to be half full when you are half-way to retirement? Something like that?

*** SPEND ‘TIL YOU DROP, BLAME THE ECONOMY THEN RAISE TAXES, NO? *** ZOMBIE WISDOM ***