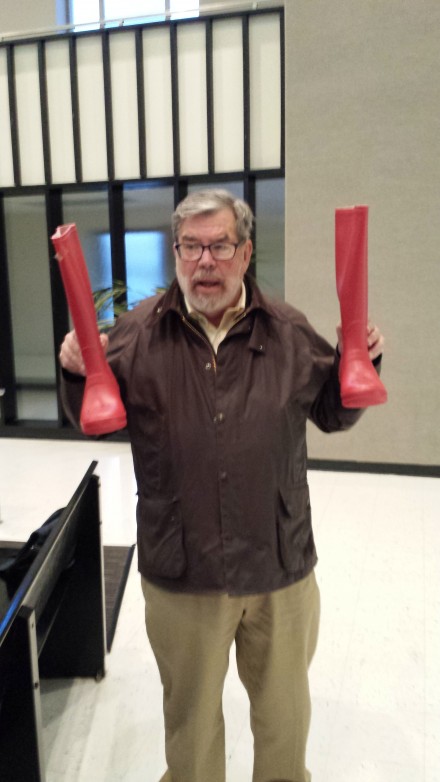

When a city snow removal effort a few years ago hit the skids, citizen fiscal watchdog John Marshall Lee brought out a snow shovel to illustrate how taxpayers had to dig their way out of homes as well as city financial lapses. Monday night, at his regular address to the City Council, Lee brought along a pair of red boots signifying the city’s in-the-red condition. From Lee:

I am pleased to visit with you this evening in advance of the presentation by Mayor Ganim of the Operating Budget for the coming year. As you go about this work will you remember that the current approved budget is projected “in the red” some $12-16 Million by June? Will you keep in mind the recently delivered Comprehensive Annual Financial Report for the FY 2014-15 that shows the City Balance Sheet to be “in the red” also by at least $50.3 Million? And that was calculated with 2008 City land and building values. If being “in the red” is an unfamiliar term to you, it came about when fiscal reports used red ink, to call attention to negative or worrisome financial results.

More familiar to us today is the situation of homes purchased 10 years ago at values that seemed to go up almost automatically but later fell precipitously. Some people with few real dollars invested were able to borrow 100% of a real estate deal. So when market values fell after 2008 and debt remained high, people termed the property “underwater.” The debt total was greater than the market value. That was a bad deal for many, led to additional foreclosures, and falling real estate values in the community.

Most of you know that positive signs of economic development include new businesses. Businesses come and go. But eight years ago Fairfield Avenue welcomed TWO BOOTS that provided good food, beverages, and varied entertainment. Recently they closed and moved out of town. As a partial tribute to them, but primarily to keep your 20 minds on the obvious matter of fiscal discipline, I am presenting TWO BOOTS to you tonight symbolically.

You can see two large red rubber boots in front of us tonight. Red is for our financial condition. Remember when Nancy Sinatra talked about ‘boots made for walking?’ And these rubber boots are made for walking, in water, because when both budget report and balance sheet are negative, we are dealing with an underwater condition. The boots are symbolic of our conditions today.

I call the first boot Operating Budget or OB for short and the second boot, Balance Sheet, or BS for short. At the moment you have been presented with a Capital Budget “plan” by the administration. Neither you nor the G2 has held a public meeting on this Charter subject where ideas on Capital spending can be addressed by the public and also for comments on exactly how the City proposes to handle $40 Million additional in debt. Why do we continue to fund items that have lifetimes shorter than 20-year bonding? Aren’t they supposed to be funded in the Operating Budget? And how much past Bond authorization exists today without going to markets? Or how much money is contained in each project or plan funded in the past but not completed? Where is that information at a time when we are “in the red?”

Over the next month your Budget and Appropriations Committee will labor over the G2 budget documents. Do you have a goal in mind? Have you discussed your goal in any session? When the Board of Education comes in with their budget showing $10, 15 or 20 Million more needed to balance their budget, how will your numbers measure down to meet the needs of the youth of the community? How will you prioritize other City services? You will find increased pension and public safety funding because of decisions and deferrals of the past eight years. You will have difficult choices, but isn’t that why you chose to serve the public? Isn’t that part of the duty you owe to those who voted for you?

The water is rising everywhere. That is why the State and Federal government have provided $50 Million or more to prepare a sustainable plan and get on with it in the South End. You must do your part for sustainability for taxpayers. The line may have been drawn in the sand in the past, but the line is gone from sight. Drain the operating budget of liberal revenue assumptions and chart realistic expense projections, based on facts. For the balance sheet, understand the numbers and help us only add liabilities through borrowing where we make serious gains in net worth. Why not hire some independent and professional assistance in your work? Time will tell.

JML, I don’t how many members remember Nancy Sinatra’s “boots made for walking,” because the song came out in 1966.

youtu.be/SbyAZQ45uww

The City of Bridgeport CANNOT fund itself to the tune of several hundreds of millions of dollars EVERY SINGLE YEAR. What is the deficit between what is raised within the borders of the City of Bridgeport (PROPERTY TAXES) and all the additional revenues coming into the coffers of the City of Bridgeport? Aren’t we really short something to the tune of $500 million EVERY SINGLE YEAR? So the answer to Bridgeport’s dilemma is so much deeper than these boots can go and will take a solid two decades to reverse IF we have visionary leaders who will be guided by the principles of good governance. I do believe it can happen. It will be very difficult.

youtu.be/ejLwyNqRzWc

Gotta love the visuals JML brings to the party. And oh how I wish they would heed his messages.

Jennifer,

Good to know you continue your prudent fiscal advocacy. Every time I speak, the CC members get a copy of my written message sent to their City email. What they do with it afterwards is mostly unknown to me. Who thinks the CC members really understand what their role is and how important it is to the City, all of the City? Time will tell.

Great visuals, JML! The boots will come in handy when we (potentially) get hit with the increased sewer load from Trumbull (and Monroe).

It would be great if the Trumbull sewer deal and discussions of the proposed regional sewer system were to be presented to the Bridgeport public, on an OATs basis, before the ribbon-cutting ceremony for the expanded waterfront facility takes place.

Senator Marilyn Moore has been pushing for a regionalized sewage system on Trumbull and Monroe’s behalf. Perhaps Senator Moore can bring us up to date on this ill-conceived proposal.

(Just to reiterate)

Jeff Kohut // Apr 5, 2016 at 6:10 pm

I’m afraid the Trumbull sewer deal will be pushed as the necessary first step in creating a regionalized sewer system that will be presented to the people of Bridgeport as a panacea for our budget woes, but it will result in Bridgeport tax base (present and real) being diverted to Trumbull and Monroe (as well as Bridgeport taxpayers picking up the tab for the new infrastructure).

The sewer deal will result in Bridgeport getting the “dirty” end of the stick as usual. We will wind up subsidizing Trumbull (and later, Monroe) tax base growth and suburban lifestyle as more of the crushing regional tax burden is shifted to Bridgeport property owners (to pay for the expanded regional sewer system), especially homeowners.

In the meantime, we will continue to support Trumbull’s tax base and lifestyle, even as they lure more lucrative development to Trumbull by way of access to our sanitary sewer system.

THE PEOPLE OF BRIDGEPORT NEED TO SEE THE PROPOSED TRUMBULL SEWER DEAL BEFORE THE COUNCIL VOTES ON IT AND THE S*&^ HITS THE FAN!

LENNIE; CAN YOU PLEASE SECURE COPIES OF THE DOCUMENT CONCERNING THE PROPOSED BRIDGEPORT-TRUMBULL SEWER DEAL AND PUBLISH IT ON OIB FOR US?

IN A RELATED VEIN; DO YOU HAVE ANY INFORMATION CONCERNING ANY PROPOSAL TO REGIONALIZE OUR SEWER SYSTEM THAT YOU CAN SHARE ON OIB? (THE PEOPLE OF BRIDGEPORT NEED TO HAVE SOME IDEA WHAT HARTFORD AND THE REGION HAS IN MIND FOR US, IN THIS REGARD, BEFORE MALLOY AND HIMES AND BLUMENTHAL SHOW UP FOR THE RIBBON-CUTTING CEREMONY ON THIS PROJECT.)

I will be more direct. Timmie Herbst is going to get a good deal. Go figure out WHY???

AND let’s not forget Monroe has a notorious reputation for rejecting budgets. Monroe is a dead end, fiscally.

There are more than enough dickheads in this administration who can wear those rubbers as hats.

Those boots are Andrew’s retired firefighter boots.

Did JML move into a Condominium?

JML, will you PLEASE explain to me why you keep saying the balance sheet is in the red? A balance sheet formula states that Assets EQUAL liabilities plus equity.

Since the liabilities can’t be greater than the assets, I don’t know how you’re coming up with this statement the balance sheet is in the red.

Think about getting a refund on you accounting degree.

Balance Sheet: Assets = Liabilities + Equity

If Liabilities > Assets you have negative equity.

God Bless You, Brick, for asking this question.

You have stated that liabilities can’t be greater than assets. Will you please report where you learned this?

Your Formula: “A balance sheet formula states that Assets EQUAL liabilities plus equity.” is correct, but did you realize ‘equity’ or ‘net worth’ can be NEGATIVE, as well as positive? In fact that is what happens practically in a bankruptcy. Assets are totaled. Liabilities are added up and then we find that with liabilities greater than assets, the property is UNDERWATER or as I am terming it, IN THE RED.

I am using RED so people notice. Now is the City ready to go BANKRUPT? I don’t think so but we have been trending in this NEGATIVE direction for too many years now and just passed into the RED in the past 12 months on both the Operating Budget and the Balance Sheet. Has the CT POST announced it? Has Channel 12 given coverage to what Finch did to the Operating Budget or to the City balance sheet ending in June 2015? Not everyone is calling in their debt today so we are not feeling pressed. But should we be feeling content or impressed with where we are? I suggest NOT.

The Pension Obligations and the Outstanding Bonds are not all due today. With liabilities spread over time and interest rates ready to trend up after more than 30 years of overall decrease, there will likely come a moment where the decreasing values seen by City taxpayers for their homes will conflict with the tax increases payable to the City annually.

CONSTRUCTIVELY: Let’s see a printout in Executive Summary Form of the Grand List, with categories sorting out values for Federal Property, State Property, City property in use for schools, parks, municipal buildings; Universities and Hospitals (where we get some State PILOT); non-profits and church owners where nothing is received; taxpaying property that is subject to abatement or other such agreements that lessen what they pay; and then the total values of 100% taxpayers. Shouldn’t the public taxpayers and especially the CC members have such info and be aware of our RED category when they are asked for decisions?

If we look for the trends in these categories from year to year, we can see where the pain is being delivered and felt. We can better understand different methods of valuation and taxation. We will be better prepared to ask why the G2 administration has found it necessary to budget for nearly $30 Million of increases, do you? And why the BOE has been flat budgeted that will cause $15 Million of cuts that will affect results? Perhaps we need to officially provide for more time in the reviewing schedule so the Council can look at all budgets and operations? Time will tell.