Figuring out your tax bill based on the property assessment can be a mind-numbing experience. What do these numbers mean?

To calculate your property tax multiply the property assessment by the mil rate and divide by 1,000. You can’t do that yet for the budget year starting July 1 because the mil rate won’t be set officially until June.

By April, city bean counters will have a better handle on the general range of the rate. Currently it’s 54. It will go down based on the overall citywide grand list growth, but by how much? Will it be 43, 44, 45?

So the time to challenge assessments is now.

Based on information shared with the City Council’s budget committee, neighborhoods that experienced hefty tax increases four years ago will see some relief while other areas that saw drops may see hikes. These things tend to be grouped by neighborhoods based on similar housing demographics. But all assessments are unique so there can be some outliers in sections of the city.

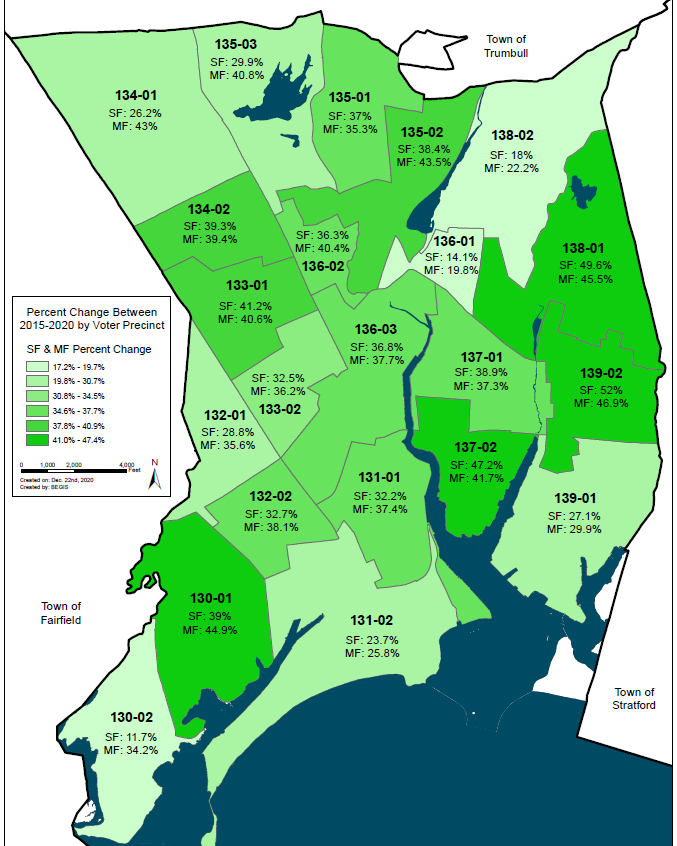

Mike Fazio and Chris Kerin, executives at Fairfield-based Municipal Valuation Services, a leading assessment company in Connecticut, provided councilors Monday night with a general overview of the revaluation results required every five years by state law. A map was shared highlighting the respective neighborhood revaluation changes from five years ago. Areas in lighter shades should experience tax relief, or remain flat while darker shaded areas may receive a hike because of elevated assessments. Good news is your property is worth more, on the other hand if the mil rate doesn’t drop enough to offset that new value your tax bill in July will be higher.

Upper East Side Council member Maria Pereira expressed concern Monday night as a participant on the virtual meeting. Pereira is not a member of the budget committee, not a member of any committee, in fact, but councilors are allowed to ask questions acknowledged by the chair.

Suspicious of the current numbers, Pereira asserted that poorer areas with rising values may be disproportionately hit. Again, depends on the final mil rate.

Finance Director Ken Flatto says property owners can expect to see a drop in the mil rate from the current 54 to the mid 40s, a reflection of “enhancing the value of homes and commercial properties in our city.”

One mil currently represents about $6 million so a difference in a couple of mils alone will impact the coming tax bill.

In a statement issued to OIB on Tuesday, Pereira highlights her concerns. She also attached the map shared with council members Monday night.

Out of concern for misinformation being provided to severely overburdened taxpayers in Bridgeport, I am forwarding you the map that was discussed at last night’s B & A meeting during the discussion on re-evaluation.

Not a single district’s single family (SF) or multi-family (MF) property values were decreased. The lowest increase on single family homes was 11.7% in Black Rock followed by 136-01 which surrounds the Beardsley Park area where Bill Finch lives at 14.1% followed by the Thomas Hooker Precinct at 18%.

Multi-family home values have skyrocketed with the lowest increases in the Beardsley Park Precinct where Bill Finch resides at a 19.8% increase followed by the Thomas Hooker Precinct at 22.2% and the Seaside Park Area with a 25.8% increase.

The current mil rate is 54.2. Even if the mil rate was lowered to 44.0 mils that would only equate to a 19% reduction in the mil rate.

This would only provide single family homes in Black Rock with any meaningful tax reduction. Single family homes in the Beardsley Park area would see a slight reduction with Thomas Hooker Precinct remaining flat.

Not a SINGLE neighborhood would see a tax reduction on multi-family homes. Multi-family homes would see between a 1% to 28% increase in their assessed value which means at even a 10 point drop in the mil rate; most homes would see a substantial increase in their real estate taxes.

The largest tax increases are in the most impoverished and densely populated neighborhoods including the Warren Harding, JFK, Aquaculture, Wilbur Cross, Barnum and two sections in the north end. In addition, apartment buildings and cooperatives saw the largest increase in property values in the Commercial category which means out-of-town developers will pass their significant tax increases onto those least likely to afford it, renters in complexes.

139-02 Warren Harding High School Precinct property values are increasing the most with SF by 52% and MF by 46.9%.

I am just using an average assessed property value of $200,000

$200,000 x 54.2 mils = $10,840 in real estate taxes

$200,000 x 46.9% increase = $97,800 totaling $297,800.

$297,800 x 54.2% mils = $16,140 in real estate taxes

$297,800 x 44.0 mils = $13,103

A house with a current assessed value of $200,000 at 54.2 mils pays $10,840 in real estate taxes.

That exact same house with an assessed value increase at 46.9% = $297,800 with a lowered mil rate of 44 mils will now pay $13,103 in real estate taxes.

That is still an increase in real estate taxes of $2,263 which equates to a 21% increase or an additional $189.00 per month.

I am deeply disturbed by the massive increase planned in our most impoverished precincts, but especially during a pandemic and massive unemployment.

Bridgeport residents can be thankful that ALL, repeat AlL, the other council members understand this as well as Maria does!!

Lol!!!!

It’s a shuffle game, what to understand.

looking for some meaningful ends for the city as a whole.

There should be two mill rates for MF whose owner lives within the dwelling, in it and limited to two own. A lot of these dwellings are investment property that is being gobbled up, and not very well keep Taxing them at a higher mill rate will encourage Port residents ownership witha stake in the city and will office city homeowners both SF and MF relief. JS

Does this mean that Pereira is back on OIB? Welcome Cotter, or is it bogger.

[Back]

[Blogger]

Speedy, I’ve always maintained that if Pereira has something to share relevant to OIB readers, I’ll run it, and have done so. The comments section is a different story.

I understand. Don’t you both get mad at me when one day and nights you see, hear and feel the presence of protester demanding a full return of Maria Pereira and reconciliation between both. If the protests goes D.C. protest stile, don’t blame me.

Property owners? What about us renters. What’s gonna happen when Joe Ganim tears down the Greens Apartments? I’m building a tepee.

There’s more to this. Maria Pereira calculated for real estate not Motor Vehicles. Then, there are the commercial property.

P.S Do to the fact Democrats control all three branches of government, and the Port as well, is controlled by the Democratic party along with the racist era of Trump is coming to a close, and we are entering the Age of Aquarius. I am taking some time off to emphasize on me, probably write that book, maybe I should start by reading one first. BAM!🤪 Peace out OIB.

https://www.youtube.com/watch?v=fZBKTqgB1OI

As sure as the Clock Tower at the corner of Chopsey Hill Road and North Ave will never strike 12:00 again, The Suffering Tax Payers of Bridgeport will lose more money they so desperately need!

How can you think of raising Taxes with so many people out of work, in this Covid -19 pandemic!

Call the revaluation off and delay it for two years, this was done back in 2013 property revaluation under a bill passed overwhelmingly in the state House of Representatives

Joe truly believes the tax payers are stupid. He thinks he will slip in a tax increase this year and they will forget about it in a couple of years when he runs again.

If the council must take the bullet and lose a couple of seats next time so be it. He will give a few jobs and save his ass.

Let’s face it,I’d say half of the council has no idea what Maria is talking about,they will just accept what Flatto recommends.

That exactly what I meant above, Harvey. It’s the continuing problem of either uneducated, or ignorant members on the council. That coupled with other members just ‘doing what they’re told’ is one of the many reason places such as Bridgeport are “shit holes” or at least run like them. No one analyzes anything and they certainly don’t ask questions. Then others have the gall to try to silence those who do.

Cheers!

Rich,

It is good to know that you are generally in favor of digging out and assembling the facts of a situation in order to analyze issues and choices facing public agencies in setting out plans, programs, and policies. (And I assume that you are likewise in favor of oversight responsibility and review of City actions with respect to statute, law, and other responsibilities where asking questions is normal, regular and expected behavior?)

Isn’t the real issue: Is power attempting to silence the QUESTION or THE QUESTIONER? Perhaps in the medium and long run it will be better for the entire audience to become informed at a better level (including the City Council as part of such audience) and for time and information available for review to increase? Time will tell.

Of course the issue is usually “transparency”. That’s why Maria rubs people the wrong way. And what I mean by that is she makes waves where THEY SHOULD be made. Some say that it’s why she can’t get others to agree with her therefore she is unable to form “coalition’s.” I guess those who criticize her- (like here on OIB)- would rather have the status quo. That’s why nothing ever gets better. But “they” blame the one “who can’t get others on board” to get anything done instead of the rest of those who are supposed to do the right things for the citizens of Bridgeport. It’s not just a Bridgeport problem. Look at our Congress and Senate. Democrats AND Republicans!! Career politicians who have run this country into debt and beyond, but let’s blame others including the few who can’t form coalitions. “Outsiders” always get axed. If you’re not a “club” member don’t bother trying to join.

Cheers!!!!!

Perhaps this tumultuous, dangerous, rebellious year is the year for Bridgeport to assert itself against an exploitative region, complicit (in exploitation), neglectful state, and incompetent, irresponsible, thieving local government through a general tax strike(?)… If local tax funds for the city suddenly dried-up completely, that would surely get a rise out of Joe, Ned, Dick and Jim…

*** THERE’S A RIGHT WAY TO GAIN SUPPORT FOR A CREDIBLE ISSUE & A WRONG WAY.*** PEOPLE REMEMBER, NEGATIVE ACTIONS FROM THE PAST, REGARDLESS OF THE ISSUES, NO? ***