Nothing like power of incumbency less than two weeks from an election. Mayor Joe Ganim on Thursday announced an expansion of the city’s senior citizen tax relief program that also extends tax cuts to income earners up to $75,000.

City Council leadership joined the mayor for the announcement. See video announcement above.

To apply for tax relief, see here

News release from Mayor’s Office:

Today, Mayor Ganim, with the strong support of members of the Bridgeport City Council, announced a plan to expand tax relief for low to moderate income seniors in our city. Building on his expansion of tax relief a few years ago, Mayor Ganim has sent to the City Council a tax plan that will both expand the income eligibility levels for seniors to participate in the program as well as increase the amount of the tax relief that eligible seniors will receive.

Mayor Ganim has proposed this tax relief plan to address the extremely high inflation and cost of living increases that we have experienced in recent years. This senior tax relief program will provide targeted relief to many who are on fixed incomes and need the aid the most, especially those seniors impacted by the city’s last revaluation. Mayor Ganim has proposed this tax plan now so that the City Council has sufficient time to act on the ordinance and budget the tax cut in time for next fiscal year’s budget.

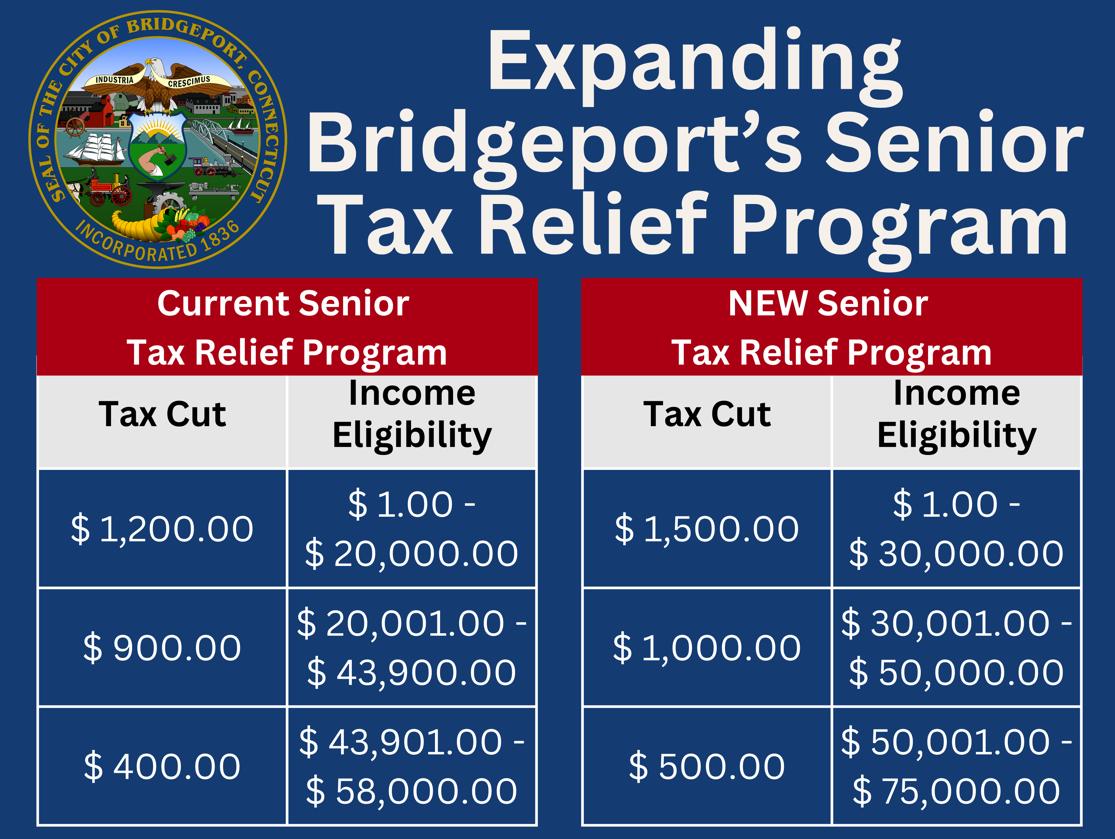

The newly proposed three-tiered senior tax cut program will provide tax relief in the amount of $1,500 for eligible seniors making a household income of between $1 and $30,000; $1,000 for household income between $30,001 and $50,000; and $500 for household income of $50,001 and $75,000. Under these new parameters, the City of Bridgeport is expected to provide over $2 million of targeted tax relief to seniors.

The Mayor’s senior tax relief proposal has been sent to the City Council for referral to the Ordinance Committee. In addition to expanding the income eligibility levels and the amount of relief, the Mayor’s proposed ordinance amendment also eliminates the cap on the total amount of aid for the program, such that all are eligible.

This expansion of tax relief, and the resulting impact on the budget, is made possible by the fact that Mayor Ganim and the City Council have demonstrated strong fiscal management, including balanced budgets, credit rating increases, and holding the line on property taxes.

Apparently the existing property tax relief to seniors in three income categories making them newly eligible for $500, $1,000 or $1,500 total limits has an annual expense of $2 Million annually. What amounts of additional relief are new limits estimated to cost?

The Comprehensive Annual Financial Report appears ready and available at the City Clerk office. Is there anything in the CAFR that might lead to questioning new more generous limits to Bridgeport seniors as they face property tax bills? When will the CAFR be noticed by the Mayoral candidates? It is a part of oversight and therefore always worthy of attention, especially the notes to the report dealing with funds from outside the City.

Time will tell.