Maybe Richard DeJesus can go to Hartford to pass stronger laws to collect from tax deadbeats like himself. Companies operated by the city councilman, the Democratic-endorsed candidate for the February 24 State Senate special election, owe roughly $140,000 in personal property taxes and interest dating back to 2003, according to an OIB review of city tax records and bills. In a unique spin on his deadbeat status, DeJesus says owing back taxes is actually a credential for seeking office.

DeJesus is listed as manager of Genesis Motorworks, LLC, 946 Noble Avenue that owes $47,831 in personal property taxes dating back to 2006. He’s also listed as president of East Coast Auto Parts, 14 River Street that owes $91,602 in personal property taxes and interest going back to 2003.

A review of city tax bills shows no recent payment to address the back taxes. Real estate taxes on those properties are current.

Last Thursday night DeJesus won the Democratic nomination following a 26-26 delegate tie broken by the endorsement chair Ed Farrow, who has an attorney-client relationship with DeJesus. Former State Senator Ed Gomes protested the tie breaker, claiming a conflict, to the state Democratic Party, but a dispute panel has upheld the endorsement. DeJesus and Gomes are competing for Connecticut’s 23rd State Senate District vacated by Andres Ayala, the new commissioner of the DMV.

Political operatives of Mayor Bill Finch supported DeJesus at the convention, but City Communications Director Brett Broesder reports Finch is not issuing an endorsement of DeJesus.

In addition to back tax issues, the State Elections Enforcement Commission is investigating DeJesus for alleged violations of election law regarding his multiple voting addresses throughout the years. The complaint was brought by DeJesus’ 2013 primary opponents.

DeJesus had a rather unique response about his deadbeat status in remarks to CT Post reporter Brian Lockhart:

While such a debt might derail some candidacies, DeJesus said it is another reason he needs to be elected to succeed Sen. Andres Ayala in the 23rd District, which also includes Stratford. He said he is just an “average Joe” who entered politics a few years ago and can relate to his constituents who are juggling bills.

“This is why I want to go to the Senate,” DeJesus said. “I feel they need someone like me that can bring this issue a new perspective. I’m a big proponent on tax reform. We have to look at this a different way and bring relief to people like me in Bridgeport and Stratford. We have to come together to find a better solution.”

But the tax bill is also more baggage for DeJesus, who is also the focus of an elections fraud probe launched by state officials after he won his 2013 City Council race.

Full Lockhart story here

Click the link and fill in DeJesus for the last name and Richard for the first name. Some interesting court battles! 10 years on for one!

civilinquiry.jud.ct.gov/PartySearch.aspx

Unbelievable! (Well maybe totally believable.) Why are Bpt Democrats supporting a tax-cheat criminal? When will these nasty people be gone? No hope for Bpt until then. VOTE them out, even if you have to hold your nose and vote for an R or WFP. They all must go, like Musto!

Looking at his real estate holdings leads one to various addresses, none make sense.

“Well Sen. Gomes, do you want an aisle seat or one closer to some of your old pals?”

DeJesus, Mary and Joseph!

Political operatives of Mayor Bill Finch supported DeJesus at the convention, but City Communications Director Brett Broesder reports Finch is not issuing an endorsement of DeJesus.

Another Finch Claude Rains moment?

www .youtube.com/watch?v=SjbPi00k_ME

I’m betting, no vetting!

Another interesting “out of town” town record!

gis.vgsi.com/newbritainct/Parcel.aspx?Pid=6830

Shocking! He is an example of how CT and Bridgeport cripples small business owners and a shining example of the complete corruption of the DTC endorsement process and the Bridgeport Machine.

Mr. DeJesus (my thoughts in fall 2013 when reviewing the candidates),

So you have a business in Bridgeport. That’s wonderful. Being self-employed removes one conflict of interest relative to running for the Council.

You employ local folks who can do the work your business offers to the public and you can make a profit? Great. That is good news! A businessman who understands financial issues on the City Council would be a good thing.

And you believe it is time to begin to share some time and experience on City matters? How public-minded of you.

BUT YOU FORGOT TO ANNOUNCE YOUR BUSINESSES ARE IN SOME DISARRAY WITH TAX PAYMENTS INCOMPLETE DATING FROM MORE THAN TEN YEARS AGO?

Why don’t you step down from the Council, make your businesses your full-time job, show the rest of us fools who are paying our taxes (providing for your Stipend, etc.) how you dig out of this, and then come back as an example of good practice? At the moment those unpaid taxes and the way the City handles them and you are as much a conflict of interest and a distraction from being an unconflicted Council person as if you had a City job.

By the way, you aren’t looking for a City job, are you? Something at the supervisory level or possibly inspecting something for $100,000 per year? Time will tell.

This is way too shocking. Why he still owns the properties without even a threat of foreclosure is something. I could say what’s the big deal, Ganim has done worse. But I am disgusted with this piece of news. Who does the vetting in this city??? I think Ed Gomes deserves the prize. I think now the Democratic Town Chair Mario Testa should issue a response. This is pretty sad and especially when you support a candidate, it is just embarrassing. I would expect GOMES to start his campaign and demand support from the DTC. Just when you think it cannot get worse, it does. Good Luck to Ed Gomes, you may not have been my first choice, but between DeJesus and the thought of that previous Mayor attempting to run, the people have had enough. I have.

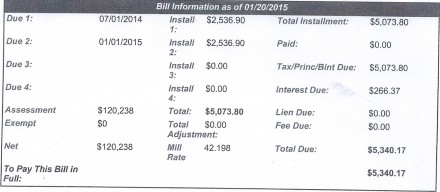

Is someone misreading his tax bills? Is someone confusing assessments with taxes due? Lol, I certainly hope I did not judge to soon. There is a huge difference between $120,000 back taxes due and $5,000. How many of these tax bills are we talking about? Please tell me we are not making a mountain out of a molehill.

That is only one of the bills. There are many more. Read the caption under the photo.

Mustang thanks, I did read the caption! How many more properties does he own to add up to $139,000??? I would have liked to see the BIG bill! Something doesn’t add up for me.

Steve, the bills go back a decade. That was just one of them. There is a cumulative bill in small print that does not reproduce for these purposes. But all the info is available on line that I reviewed and confirmed by multiple sources. DeJesus, irrespective of his claims, has not made a payment regarding the outstanding balances.

Thanks, Lennie.

This is truly disgusting!!!

Bill Finch wants a law that would prevent Joe Ganim from running for mayor but Richard DeJesus running for State Senate from Bridgeport while owing $140K in back taxes; no problem.

Richard DeJesus serving on the City Council while owing $140K in back taxes; no problem.

Mayor Finch’s Deputy Chief of Staff begging the Convention Chair to break a tie for the guy who owes $140K in back taxes; no problem.

Just another sick joke courtesy of the Finch Administration.

This is your Finch cartel, Bridgeport!!! If you can’t pay your WPCA bill, Finch will take your house!

What will be our takeaway from this NEWS?

I understand when you are invited to participate on a Board or Commission by the Mayor, there are a series of forms to be completed providing information about residence, financial issues and obligations, community experience and education as well as authorization for Police Department Internal Affairs to perform a background check. This is a reasonable practice, isn’t it?

Do we get the same info on City Council members or those who run for State office? Or do we depend on Town Committees to investigate, verify and/or report? Where was the CT Post on this one? Will someone inform us about what happens and how rapidly for missing a WPCA payment, a tax payment on a home, and a tax payment on business property? Isn’t the color of tax money GREEN? Why do we pursue back taxes in different ways? Are there any other appointed or elected members of Boards, Commissions or Council with outstanding property taxes at this time? Time will tell.

Getting away with not paying your due taxes is just another example of the stranglehold the administration has.

Mr. DeJesus is apparently the Kenneth Moales Jr. of the City Council.

Interestingly enough, he had plenty of money to hire a high-powered attorney to represent him on the SEEC complaint and he had plenty of money to hire another high-powered attorney to represent him this week regarding the DSC panel with the dispute over his nomination.

But apparently he has no money for his exorbitant past-due taxes. After all, who cares about those pesky taxes?

From the CT Post:

“As a small business owner and job creator, it’s not easy,” he said. “You’ve got to make tough choices every day–pay down on the taxes you owe or lay one of the guys who’s been with you off.”

Or pay high-powered attorneys, I guess.

I am a friend of Rick DeJesus and I have to say I am sad and shocked at the story listed above. I never thought Rick was a tax deadbeat.

It is time for this city and this damned administration to start vetting people who are candidates for office and are city job applicants. We have had enough of this political bullshit. How did we hire people to run Dunbar School and not know their credentials were phony and somewhere in this mess we hired a convicted sex offender. How did we have a convicted felon teach classes at the police academy?

It’s time for Rick to withdraw from the senate race and give up his seat on the council.

If this does not wake up the city Democrats to stop blindly voting for endorsed candidates, there is no hope.

Jennifer Buchanan, you are right, it should be a wake-up call to the city Democrats but it should also be a wake-up call to the city Republicans. Jennifer, I strongly suggest like-minded like you and JML become Democrats and take over the 130th district on the DTC, because you would have better chance to make changes as Democrat than as a Republican.

This has been suggested to me more than once Ron, and I am flattered that you invite me into the fold. Sadly, I think I would be held in great suspicion. Danny Roach strongly encouraged me to at the very least join the RTC. I must subconsciously belong to the Groucho Marx club …

Jennifer Buchanan, it doesn’t matter that you would be held in great suspicion. Look, Danny Roach I were on the DTC in the 130th district for a while then the district lines were changed and I placed back in the 131st district. Danny Roach was my district leader and I like Danny because he is someone who will listen to you. The only power to make changes is in the Democratic Party Town Committee. DTC don’t like to be primary, most of them don’t like to go door to door to get signatures so put a slate together of you and eight other like-minded people and see what happens, hey, Danny might offer you a spot on his slate, but run.

Ron,

Would that we have coffee some time so you would remember I am a Democrat. And perhaps some of the other things that I work on would become clearer to you as well.

And based on voting in the City of Bridgeport in the past seven years or so, isn’t there any question in your mind as to the extent of the actual “voting power” or control by the DTC? What were their positions on Library funding? On Charter Reform? On BOE candidates, who had identified at one time in the past as Democrats, but perhaps saw more need for using their own voice? Is that the virus alive in the City at this time? How many Democrats do you need running in a State Representative election to provide an opportunity for a Republican to win? Time will tell.

My question is: Did DeJesus send Ed Farrow “soap on a rope” for Xmas or was it vice (no pun) versa, or did Mario buy it with his CostCo card and get a free one for himself?

This was NOT Mario Testa. This my friend, was Adam Wood.

“This is why I want to go to the Senate,” DeJesus said. “I feel they need someone like me that can bring this issue a new perspective. I’m a big proponent on tax reform. We have to look at this a different way and bring relief to people like me in Bridgeport and Stratford. We have to come together to find a better solution.” Seriously? You said that. You really said that. You allowed that quote to be published.

Big proponent for tax reform, just not a big proponent for paying your bills.

You and your moron lawyer deserve each other. This whole situation is playing out like an episode of Veep, but without the bitchen wardrobe.

Pardon me while I resume my dry heaves.

True. I too am ill–vertigo from the spin. My burning question is, who squelched this information during the city council race? This person is voting on spending my tax dollars–could he share his tips on how to not pay taxes and get elected? Oh yes, get the DTC endorsement.

Hear hear!

Where do we go for a statement on how the City comes to an agreement to accept current taxes and allows back taxes to remain unpaid, without a current schedule that is due in addition to the current taxes? The State sets an interest rate, I believe, of up to 18%. How much of these bills represents high interest rates that have added to the burden? And as a property owner does he have lines of credit or other forms of equity as collateral to get a loan with lower interest with the record low interest rates available?

The failure to pay taxes preceded Mayor Finch by a few years, but if the interest build-up has grown during the Finch years, why are the consequences for this taxpayer different? How much of our back tax burden is from businesses still functioning?

By the way, my memory tells me the City wipes the taxes off the books after 15 years. Is this the plan for the $140,000? Perhaps Adam Wood can prepare a PowerPoint to explain the thinking of this administration. Time will tell.

Well here is some material. These are the Council Committees DeJesus sits on:

Committee on Ordinances

Committee on Economic Development (I shit you not)

Committee on Contracts–Co chair with Howard Austin

Special committee on CDBG Program–Co chair with Jack Banta

AND he is a Deputy Majority Leader–not bad for a freshman Councilman.

Can someone please explain how DeJesus becoming a State Senator can impact the personal taxes on his businesses located in Bridgeport? Aren’t those taxes based on the municipal tax rates, not state? I am not knowledgeable regarding this particular area. Help!!!

Ms. Pereira,

Whether because of government employment, knowledge of something that might be a public embarrassment or some special deal, a person can become beholden, compromised or otherwise NOT independent and therefore subject to suggestion and vote as a legislator. All are grounds for potential corruption, in my opinion.

If the idea of current tax collector, City attorney, and others in leadership is to let taxes from 2003 to reach 2018 and depart from the books as a debt, then that would be special treatment, wouldn’t it? And if the long period of outstanding debt is being handled differently, we need to hear about it and why.

Little people have big expenses mounting quickly when a WPCA bill is ignored. And some get to lien stage and beyond while they do not understand what has happened. Is this justice? What deals are being cut on City property taxes owed? Isn’t that the question? Time will tell.

I get that and you have good points, however Dejesus said the excessive personal taxes on his two businesses is why he wants to become a senator. Does the legislature enact laws that increase, or decrease personal taxes on a business located in Bridgeport? Aren’t those decisions made by the City Council, not the legislature? Aren’t the personal taxes based on the mil rate set by the council?

Credit to you for seeing the flaw in the spin.

I have not taken the time to look at the old tax bills and I should. The City collects property taxes on land and buildings (per revaluation data every ten years and in between), on automobiles (with annual values from the State) and on business personal property (machines, equipment and other “stuff” that is tangible, owned and used in the business enterprise per valuation by the Assessor office).

All three values are used in computation to come up with assessed value that is multiplied by the mil rate. The mil rate is not so much set by the Council as it is a result of the Council approving the Annual Operating budget for City and BOE. That approved budget number, divided by the Net Taxable Grand list arrives at the mil rate.

Who has the most direct responsibility for growing the Net Taxable Grand List? The Mayor’s Office and OPED? But what happens when the City purchases property and keeps it off the Grand List? Or provides loopholes and tax deals so that properties otherwise 100% tax responsibilities have them abated?

And who is responsible for “business personal property” valuations and appeals therefrom? How is that working out? Time will tell.

DeJesus becoming a senator will not impact the taxes he presently owes. It is political BS that he is going to Hartford to try to change the tax laws. If he wins he will be a freshman senator and have no clout. It is simple, pay your taxes on time and save interest payments.

CT Post on formal complaint filed against Denise Merrill for allowing Mitch Robles to continue to be a Notary although he repeatedly lied about his criminal convictions on his renewal applications.

www .ctpost.com/local/article/State-checking-complaint-about-notary-6033609.php

At least neither Angel Depara nor Carlos Silva owed the city taxes. MS you are correct, Mario Testa is not the one!

Thank Americo, Andres, Carmen and a few others for the choices made in the 136th.

And then again, Rick has a good point, he might be able to bring awareness to these high taxes and find a way to keep them from going higher.

Here is a very simple reform. Require by ordinance the city post every January 31 the tax status of every elected officer in the city including mayor, city clerk, town clerk, council members, BOE members and members of all boards and commissions.

Have all of the same officials mentioned above file annual statements declaring any LLC’s they are members of and any corporations for which they serve as officers.

Rick Torres, do you really want to start addressing institutional corruption?

I heard from his campaign his platform is to decrease taxes.

Did he vote to approve the budget to raise our taxes last year?

He was properly vetted. Corvetted.

The spin is now out of control.

From the CT Post

“But,” the mayor’s office added, “That doesn’t take away from his right to run for state Senate [his delinquent taxes], if he so chooses. He’s a councilman and well-respected job creator in our community.”

This is 10 times worse. It would be one thing if he wasn’t a councilman but HE IS. And apparently Finch and his administration do not see anything wrong with that!!!!

A sitting Bridgeport Council member owes the city $140,000 in back taxes and Finch says its his right to run for State Senate as a well-respected councilman.

Bob,

“Job creator” seems to be a term much in use these days though I am at a loss for a good definition. When a lawyer is hired by the City Administration Office to supervise the City Attorney Office although there is already such a supervisor in the City Attorney Office, what does she supervise? How does that benefit the taxpayer? More importantly does it make Mayor Finch a “job creator???” Time will tell.

Sociopaths believe their own lies. They should set up a Kool-Aid stand at 999 Broad.

That’s where the City Council meets, right?Lawn furniture makes Bridgeport look like a rummage sale. Street furniture is what Bridgeport needs.

–> www .jcdecauxna.com/street-furniture/street-furniture-media-products

LE,

And what businesses would wish to advertise in downtown Bridgeport? Marketing what to whom? If the value of the advertising revenue supports the size and sophistication of the “street furniture,” what would a downtown installation look like? Time will tell.