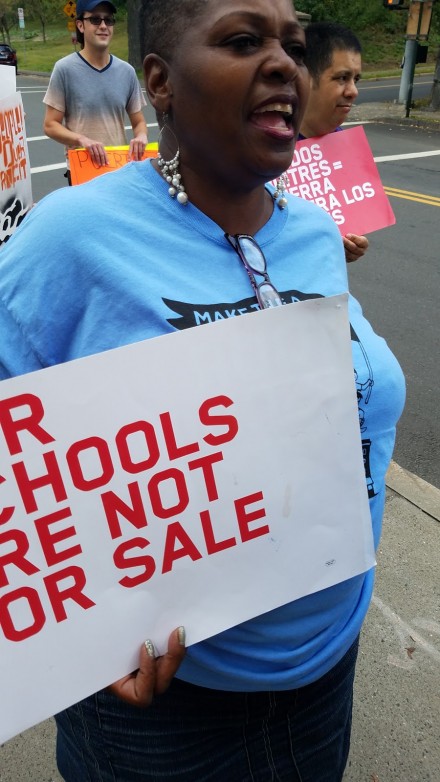

In advance of the weekend state budget vote, a Connecticut Working Families Party-led caravan of tax justice demonstrators protested Bruce McGuire’s Connecticut Hedge Fund Association, “the foremost group lobbying against closing the egregious Carried Interest Tax Loophole, outside their fancy yacht club gathering,” according to the WFP. City Council candidate from the East End Wanda Simmons, who’ll appear on the WFP line in November joined the demonstrators who also rallied outside AQR Capital Management, the investment management firm that “received a $35 million handout from the state in November.” Simmons’ protest focused on the under-funding and privatization of city schools.

More on this in a WFP news release:

Local residents, workers, community leaders, clergy, and activists traveled from Bridgeport, ground zero for income inequality, to Greenwich, the wealthiest town in America. There, they demanded that the Connecticut General Assembly stop shifting the burden on the backs of working families and make the wealthy and large corporations carry their weight and pay their fair share.

Following the protest, demonstrators sent a petition to the CT General Assembly featuring four common-sense revenue proposals. Over the past week, the petition was signed by hundreds of Connecticut residents tired of workers constantly taking the hit for a budget crisis they didn’t create. “Enough is enough,” signers declared, exasperated with continued talks of service cuts, layoffs, concessions, and regressive taxes while a privileged few continue to exploit the state without accountability.

The proposals for fairly and sustainably closing the $3.5 billion deficit include closing the Carried Interest Tax Loophole (over $520 million per year), raising the income tax on millionaires who currently pay half the effective tax rate of the rest of us (over $217.3 million for every half a percentage point), cutting corporate tax giveaways (which added up to $707 million in 2017 alone), and implementing the Low Wage Employer Fee on large corporations that exploit taxpayers to sustain their low-wage employees ($305 million annually).

If the CT General Assembly refuses to make the wealthy pay their fair share, the state will be harmed by more cuts to schools and hospitals and more regressive taxes on working families. Connecticut has more millionaires and billionaires than ever, and they must be part of the solution.

The crowd rallied alongside the Hartford Hot Several brass marching band from AQR to the gates of the CT Hedge Fund Association’s quarterly gathering at the Indian Harbor Yacht Club to deliver their message. Activists chanted phrases including “pay your fair share” and “tax the rich,” accompanied by a visual display featuring large inflatables and a wide array of signs highlighting an outrageous tax structure and the harms it does to our state.

The protest and petition join other actions by high net worth individuals, clergy, workers, and activists to fix the budget by making the rich pay their fair share. Connecticut is over-reliant on finance and needs just revenue in order to close its deficit and invest in a diversified economy and a future of growth for everyone. Connecticut’s working families are ready to #StopHedgeFundGreed, #ClosetheTaxLoophole, and #TaxtheRich to achieve a stronger Connecticut and an economy that works for everyone.

Much of what the protesters claim is accurate.

Unfortunately, their lack of credibility makes the message fall on deaf ears. They tend to be the same people who protest immigration law enforcement, demand more social services funding, etc.

Greenwich gets $1,000,000 more in school spending.

Bridgeport loses $7,000,000.

That is not credibility that is incredulous.

You say that their message loses credibility I say that the Republican Party loses credibility when low income tax credits increase four fold. Republicans just stick it to the poor folk while they get tax breaks.