Government watchdog John Marshall Lee addressed the City Council Monday night as the city’s legislative body commences review of Mayor Bill Finch’s budget proposal calling for a 2.5 mil tax increase. His remarks follow:

Would everyone reflect for a moment on the members of our City Council? Twenty adult persons who have run for office in the largest City in the State, who are attempting to carry both the representation responsibilities and the legislative and oversight duties for our City. It is a difficult job, especially since it is a part-time job and you have no staff to assist you. The issues you face are complicated. Often you are faced with concerns that demand immediate decisions. In the absence of your own staff, you have to rely instead on City officials who are not independent of the Administration you are supposed to monitor and oversee as a fundamental part of systematic checks and balance. That’s a big problem because as Council members you have been elected to represent the taxpayers and be independent of the Mayor and his or her Administration.

The Budget for 2013-14 will be presented to you this evening right before the Charter deadline. You must review it in Special Hearings over 4-5 weeks along with at least one public meeting. This timeline is not appropriate or fair to you.

Is the Administration treating you with respect and understanding? Is it providing you with enough information and adequate time to perform this annual duty? Or do you feel an intense pressure from the short time frame, the absence of staff support, and the lack of adequate information?

Mayor Finch is Chief Executive Officer of the City. He has all of the information available at a snap of his fingers and the greatest authority to make it available in any way and timing he chooses. When he ran for re-election he promised he would “hold the line on taxes.” Last year he broke that promise and you were complicit in accepting a tax increase. Yes, you reduced it lower than the Mayor asked, but your approval included at least $4 Million of “ghost expenses” (vacant positions that were funded last May by your vote), as well as a significant pay raise for the Mayor and a number of City managers. In September, 2012 the Administration removed $3.6 Million of those ghost positions with no comment to the public or the press. What happened to that money? Where is it being spent? Are you receiving information in a variance narrative monthly?

It should be clear there should be NO TAX INCREASE this year for already highly taxed City taxpayers. Rather you should insist upon some budget discipline. This starts with you. I respectfully suggest you DEMAND from this administration, if it is not originally provided later this evening, an ALTERNATIVE BUDGET; with reasonable assumptions as to Federal and State revenues; which holds the line on all operating expenses, so total spending remains level; which identifies the cuts that have to be made so you understand CEO priorities and then can see how they stack up next to your own priorities as representatives; and finally which does not borrow to cover operating costs; and DOES NOT RAISE TAXES. Ask for it, insist on it if you must, but get it and review it. Then you will be prepared to discuss it with the public in the public hearing you will schedule.

If one or more of the budgets presented does not meet the above criteria, several things will be obvious:

• The Mayor will be breaking his campaign promise once again.

• Raising taxes will further reduce property values as well as attractiveness of our City as a place to live and to do business.

• The operation of the City Council for fiscal oversight will again be called into serious question as will the role of each person sitting on the Council.

Last year I heard a statement from one of the Council members that suggesting NO TAX INCREASE to the Mayor could not be done because: “The Mayor won’t like it.” Did you hear that? “The Mayor won’t like it.” What about my neighbor, an 80-year-old widow who is being taxed out of her home because the Mayor ignores important Charter duties and does not adequately control City spending? There are lots of people who vote who do not like the current tax levels much less higher ones.

Please handle your responsibilities with the strength of a functioning legislature that has a critically important oversight responsibility and check and balance role. Whether you enjoy doing it or not, that is an important part of your job as a Council member. In fairness to all of you and the taxpayers, you need to make the Administration do the number crunching and prioritizing first. That is where your review should begin. And NO TAX INCREASE is where the budget discussion should begin and end. Time will tell.

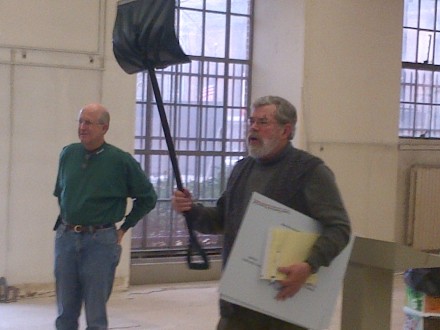

The snow shovel I raised weeks ago at Citizens Working 4 a Better Bridgeport meeting was my way of showing enduring outrage at the Mayor for his mismanagement of Mother Nature’s snowstorm. Because of the outrage of many in the City who were forced to clear their own snow or rely on the kindness of “neighbors” rather than the expertise and skill of the Administration, we were invited to a listening session emceed by Mayor Finch’s spokesperson. The Mayor wanted to know, to learn and to understand what we felt relative to what had come down. That’s what the newspaper said. But he has remained silent. No report. No cheerful change of protocol for future such events. Only the memory of at least 15 pro-Finch staged testimony to how great things were. More manipulation of the facts. He just cannot face the truth. Seems doomed to learn nothing from his mistakes.

So I raise a shovel because we need to do the lifting. Is this budget like the blizzard? I think it is. Start reading. Attend some sessions. Especially tomorrow night when the external audit is exposed to the light of day and public hearing. Let’s see what questions the Council asks. Perhaps we shall discover they have never consulted it before. Or that it is confusing for them. If they are watchdogs, don’t they care about how deficits occur when balanced budget are expected as projected?

More basically, does it bother anyone I carry that shovel to City Council meetings to show I am willing to look at the numbers the way I had to shovel the snow? Who will join with me? Time will tell.

The city’s handling of the snow removal was a disaster. And now they want to be rewarded for their incompetence with higher taxes? Malarkey!

Asked what he would tell Bridgeport residents who say they can’t afford a tax increase–the city has a median household income of about $40,000–Finch cited his own $132,000 salary.

“You know, I completely understand it. This is the most money I’ve ever made in my life and I still don’t know how you make all the bills sometimes. It’s not easy,” Finch said.

Read more: www .ctpost.com/local/article/Finch-offers-2-5-mill-tax-hike-in-519-9M-budget-4401640.php

However the administration might be low-balling that tax hike. The mayor said the average household pays $6,839.38 in taxes. His budget would increase the mil rate to 43.61 mils, which adds $400 to average residential tax bills, not Finch’s stated $215.

Figures Don’t Lie, But Liars Do Figure.

The Bill Finch Song:

www .youtube.com/watch?v=0_7XKZVibSo

All he wants to do is lie about taxes: Lie Finchy, Lie …

*** What do you expect from a city council where 50% don’t have a clue? *** MIRACLES FOR SALE ***