We all want to be number one for something, but why does it have to be this list! Snarl. Growl. Screech. H&R Block reports Bridgeport is the proud owner of the number one tax burden in the country. And judging by Governor Dannel Malloy’s proposed budget it ain’t gonna look much better. Hey, here’s an idea, how about hooking up Bridgeport with a blood transfusion from Greenwich’s tax rate? From the Block Heads:

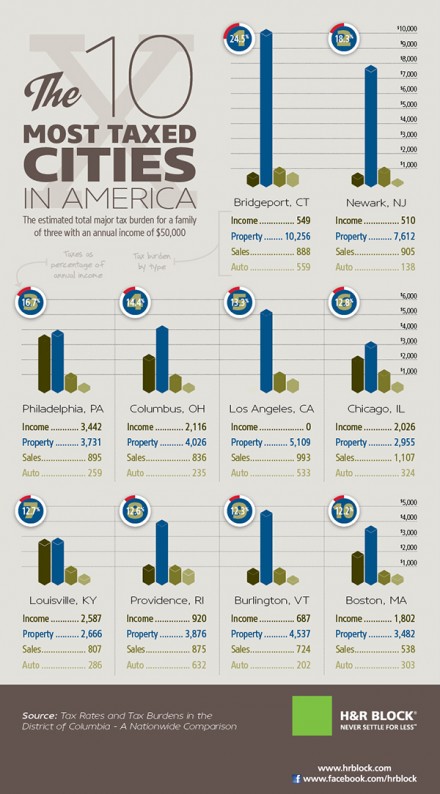

#1 Bridgeport, CT

Connecticut’s largest city is one of NYC’s outlying suburbs, and an average family of three forks over a staggering 24.5% of their income to state & local taxes. That works out to about $12,250, over $10,000 of which is property tax alone.

Okay, so the Northeast is expensive. And for the record, the least-taxed cities on the list were Billings, MT (6.4%), New Orleans, LA (5.7%) and Cheyenne, WY (4.3%).

Check out the stats in our infographic below. And don’t forget: no matter where you live, there’s a good chance there’s an H&R Block nearby–call us for tax prep help!

Yadda, yadda, yadda.

Read all the tax lament here.

This was brought up on CNBC’s Morning Joe this morning with Mika expressing surprise and Scarborough saying sarcastically, that’s why Bridgeport is doing so well in attracting business.

How many on this list are essentially one-party Democrat-controlled cities? I bet 7 out of 10.

But let’s keep electing the same people back to office in Bridgeport and Hartford State House.

Of course high taxes discourage businesses from coming here, as does one-party rule. But what about the mindset of politicians from McLevy to Finch who had no vision, no planning skills and have cared more about themselves and getting rich than about the people? What also about the people here who are constantly used to benefit a few well-greased politicians and are too dumb to realize it? Prepare for an implosion. The city can’t be sustained much longer.

*** Seems when Bpt is rated number #1 in anything in America, it’s usually something negative. Or is this just another OIB negative-type gripe that’s based more on rumor and personal opinion than facts? It can’t all be made up now, or could it? *** LORD HELPS THOSE WHO CAN’T THEMSELVES, NO? ***

All 10 of these cities are former industrial centers that have been decimated by 48 years of deficit spending and inflation. If you want to understand the Bridgeport of today, it’s important to understand what Congress started on July 30, 1965. No place was hurt more than Bridgeport CT USA and that’s why taxes here are so high. But here’s the good news: debt has reached its point of diminishing returns and a major trend reversal is underway. Bridgeport will be a beneficiary.

Seek the truth! Discover facts? Question assumptions? Reflect on findings?

I believe the article exhibits some shortcut convenient thinking that sets Bridgeport at the peak of the local/State tax pinnacle. The root of the problem for that ‘family of three’ living in Bridgeport is the value of the median residence in Bridgeport is half that in the report. The average home is not selling for $360,000. That was the value to which our 41 mil rate was applied.

Essentially that assumption doubled our City property tax. There is an inverse correlation between the levels of property tax by a City and the actual market value of residential property on sale. That is why owners in Bridgeport will often talk about paying taxes of a certain level that would equate to property valued at twice as much in Fairfield for example.

Bridgeport’s taxes are as high as they are because the administration of the City has no practical watchdogs who concern them (newspaper, media, City Council/committees); they have managed to limit the ability of the public to speak at meetings and hearings; and through the office of the City Attorney they have controlled the intelligence and instincts of elected City Council members to look outside the City for world-class governance behavior, and rather to settle for conflicted representation by City employment-connected elected. Print or electronic info is not consistently available and is not discussed in any forum over the 12-month cycle where the public gets to talk with and question those in power. How long will this situation last? Will it take running out of necessary funds to bring about? How many taxpayers will be shocked by the news? Time will tell.

Let’s be sure we understand there are many complex factors that contribute to this …

De-Industrialization decimated Bridgeport leaving us with swaths of contaminated land and decrepit factory buildings.

A BROKEN P.I.L.O.T. system … Let’s see if we can generate tax revenue on the former jails, detention centers and court houses once we relocate them to Fairfield or Trumbull!

Executive mismanagement has also contributed greatly. That crook Ganim was the first in a long line of pay-to-play administrations.

Bridgeport has had to shoulder the burden of affordable housing for far too long and without a serious state or federal inquiry into the planning and zoning practices of our neighbor communities there will be little chance to have the same mobility enjoyed by immigrant families a generation ago.

That being said, the taxes are oppressive! However it’s going to take a comprehensive approach to really have an kind of meaningful reduction to the burden on homeowners!

Brick, I have no quibble with your statements that many factors are in play. However, one factor under City control is the budget that is formed, offered to the Council by March 1, referred to B & A, reviewed in a fashion, and returned to CC for vote. Budget Oversight Bridgeport has maintained for the past two years employee totals across many departments have been padded for years, including the current 2012-13 to the extent of $4-5 Million.

In September 2012 the budget showed net reductions over 60 department headings in Line Item 51000 which is Full Time Earned Pay in the chart of accounts. The monthly variance report indicated the reduction of $3.6 Million with NO EXPLANATION and no variance narrative at all (and no healthcare expense or other benefit expense).

More attention on reducing the budget and being a watchdog is necessary. You and others can do something about this first step in the expensive and lonely duty of being a Bridgeport property taxpayer. Would you be interested in joining the observer team of BOB this year? Does anybody? Time will tell.

Cutting line items and services in the budget would knock only a few dollars off of any property tax bill. To make a serious impact a more comprehensive approach is necessary and involves multiple strategies.

There are two things that can be done, increase revenue or decrease spending. Any meaningful decrease in spending will adversely affect the poor and highest-risk population in the city. Increased revenue by the city can be made only by adding new fees or properties to the roll.

From that concept, we would need to either reduce the population dependent upon city services or increase payments made from non-personal home property tax. I think the population would decrease if our neighbors would allow and provide more affordable housing development options. Secondly, the county should pay a tax for having Bridgeport house the jails and courts and other state and federal non-taxpaying municipal buildings aka P.I.L.O.T. reform.

If the budget is 80% personnel costs, current and future, then budget cuts where efficiencies are not being achieved will reduce current taxes. Do not knock thoughtful budget analysis and oversight. This is not being accomplished in this City under the Finch administration.

Look to the September monthly City financial report with $3,600,000 net decrease in 51000 Line Item for Full Time Compensation. How do you cut $3.6 Million three months into a budget year and make no comment about it? And the Finance Director makes no variance comment about this change throughout over 60 departmental line items? And where will these funds get spent, in what line items? And will transfers have to be made with City Council approval? A decrease in spending may only affect an employee whose job is redundant, whose work is not core to the City priorities, whose work is below par (but if there is no performance evaluation, how would we know?), or who essentially is no-show personnel. What’s the problem with any of these categories? Time will tell.