If the city, state and Bridgeport Landing, developer of the East Side renewal project Steelpointe Harbor, can nail down a deal with mega outdoor retailer Bass Pro Shops it couldn’t come soon enough. This economy has blistered the state budget that can do major damage to the city budget next year. The city needs an economic shot in the arm.

The CT Mirror reports:

State analysts are projecting a more than $1.1 billion state budget deficit in the fiscal year beginning July 1, a gap roughly one-third the size of the record-setting shortfall that Connecticut’s governor and legislature tried to close just two years ago.

The deficit for the coming year is sandwiched between the $365 million deficit Gov. Dannel P. Malloy’s administration reported Wednesday for the current fiscal year and a long-range forecast for another gap of more than $1 billion in 2014-15.

Yikes. Governor Dannel Malloy says he will do what must be done to balance the budget but that potentially comes with a lot of pain, especially if state tax collections continue to fall behind revenue projections. What happens in Hartford impacts the city budget and adds greater pressure to local taxpayers.

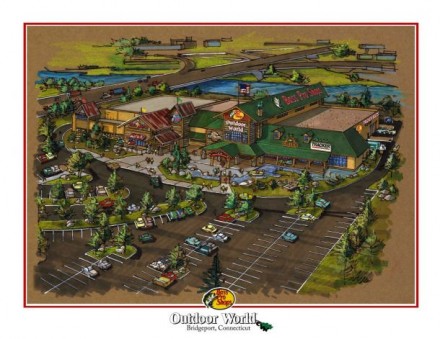

The city and state rolled out a jubilant community introduction with Bass Pro this summer. The city, state and developer have been working through the details of making Bridgeport the first urban location for the outdoor retailer. What economic impact the city projects from Bass Pro’s presence remains to be seen. The city has not specified in dollars and cents, beyond it will create jobs and increase the tax base. Bass Pro for sure will bring a jolt of enthusiasm and perhaps become a magnet for other business interests to the East Side corridor. Will the deal be done soon?

There was a time the captains of industry filled the city’s list of top 10 taxpayers. Now it’s filled largely by utilities as the top 10 list from the 2011 grand list below shows.

The Top Ten Taxpayers – Real Estate / Personal Property Combined for 2011 grand list:

Rank Owner Assessment

1 CRRA/US Bank National

Association/James Mogavera* $320,948,352

2 United Illuminating $211,997,036

3 PSEG Power Connecticut LLC $152,689,120

4 People's United Bank $58,727,604

5 Connecticut Light & Power $55,423,829

6 Bridgeport Energy LLC $36,166,277

7 Southern Connecticut Gas $34,364,683

8 AT&T Mobility $30,809,473

9 Watermark 3030 Park $29,736,500

10 Success Village Apartments $24,269,140

Total $955,132,014

Don’t expect any accrual of taxes from Bass for several years.

Take a look at the list. #1 valuation goes to the Wheelabrator plant that was successor to the quasi-government trash to energy plant operated long enough to pay off the bonds issued to build the plant. Until the pre-ordained handoff from CRRA to Wheelabrator, there was a payment in lieu of taxes PILOT. After that point the City started taxing the operating plant, but for a number of reasons dealt far more fully in court records of a trial (that are public today) the situation changed about 2008.

Wheelabrator has contested this value vigorously while paying 90% of the taxes due while appealing the valuation in court. The City is defending its position, but the trial record of expert testimony on appraisal seems kind of weak to me. But I am neither trial attorney nor judge. So we’ll let the Court come in with a decision.

However, to the extent the valuation has been too high on our largest taxpayer for several years, one might believe the City might have to adjust to a lower level the valuation and return funds to the plaintiff (or possibly keep them but forgo new taxes annually for several years). It would be expensive either way in that other taxpayers will have to pick up the revenue slack, unless the City were to get budget conscious in a serious way, suddenly. Time will tell.

This article appeared last summer:

www .theatlanticcities.com/jobs-and-economy/2012/08/why-have-so-many-cities-and-towns-given-away-so-much-money-bass-pro-shops-and-cabelas/2906/

If the economy is recovering as we are led to believe by mainstream media, shopping centers may be a good draw off the thruway. Other things (e.g. food stamp usage levels, the recent news about Hostess Brands) suggest the “shop ’til you drop” model for the American way of life may be expiring … but from the above article it does seem this is a first for Bass Pro, who have previously focused on smaller suburban locations. And we maybe want to get that project up a few more feet above sea level …

Here is a suggestion for Gov Malloy, it will not cover the deficit but it will help.

Do away with the tax exempt programs in the state. We all have had to bite the bullet in hard times especially in the large cities where we are the social conscience for the suburbs.

By doing away with the tax exempt status the state saves millions in Pilot payments and the cities finally realize a true evaluation of and for these properties.

When city hospital expand and expand and in many cases expand and take formerly taxable properties off the role,s that is WRONG. Private schools also take up a lot of city land and make no payments.

I for one am tired of subsidizing these non profits.

Andy, about those non-profits you are tired of paying taxes to provide services they as well as you enjoy, creating a subsidy situation.

How do you feel about the hospitals for whom we receive PILOT payments providing $28,000 for the YES portion of the Charter question? Do you think each CEO had to get permission from their Board of Directors to make such a contribution? Were most of those donors present at Charter Review Commission meetings to understand how it came together, and how much testimony was ignored? Would it surprise you to learn one of the two Republicans on the Committee Charles Valentino was a donor to the YES cause? (That is putting your money where your mouth is! And, if I remember, his voice was loud and clear to limit discussion, cut off debate, and adjourn the meetings at the earliest possible moment. Interesting behavior for a steward of City governance, isn’t it?)

Of course that is my opinion having attended numerous community meetings in the Finch years and being a part of the community that asks questions and therefore not readily served with answers. Charter reform is necessary according to a Letter to Editor by Dave Walker and an essay by Keila Torres Ocasio today. Perhaps the Mayor can become more ‘democratic’ by selecting members from the public who attend meetings and have a sense of necessary reform previous to the Mayor’s coaching? It could work by meeting the needs of more than one.

Andy I would not give up the PILOT payments until the substitute is in place and functioning. It will be some time, but in the meantime it might be good to research what US cities have some measure of financial responsibility placed on NGOs in their towns. Bridgeport is not unique in this regard. Time will tell.

JML, I on occasion use the hospitals in Bridgeport and my insurance pays through the nose for my usage. I do not use other non-profit services, thankfully.

To me, the hospitals overstepped their non-profit status by making those contributions. I have been told there is a loophole that allows them to do that, it seems they have the best of two worlds.

JML, all the essays I have read regarding the change in the makeup of the Board of Ed mention Finch is out to improve education with this change. I left a message for Keila how can this be when he has flatlined the BOE budget for five years.

As far as I am concerned everyone is missing the obvious here. Until the courses are changed so the non-college bound have a chance in the real world we have done nothing. What kid in his sophomore year is interested in verbs, adverbs and such when he knows he is not going to college? Nobody in authority has suggested course changes in the high schools to train these kids. All I ever hear is getting the kids ready for college. That is bullshit pure and simple.

How come so many of you financial experts buy into the big lie about nontaxable property?

This is more deception aimed at people blaming the city’s tax problems on the poor and the social service agencies that serve them.

Demand full accountability from the city. How much of this nontaxable property is owned by the City of Bridgeport?

New schools, new public works facility, underutilized property (City Hall Annex) and other plans to build a garage for specialized vehicles are the deadwood that clogs up the grand list.

Then look at all of the other city-owned land. Seaside Park, Beardsley Park, Steel Point, Carpenter Steel and what does the city recommend? MORE PARKS!!!

Yes, Andy is right about the hospitals but puh-lease what about the Catholic church??? No one complains about their grossly underutilized facilities adding to the Grand List Blues.

Don’t buy their lies. Demand full accountability as part of the annual report and don’t sit back and blame it all on social service agencies and storefront churches.

Grin,

What is it I have said that shows I am buying what the City is telling us??? If the nontaxable land and buildings are 45-55% of the City area, that is a fact. Where are you whenever the City has brought forward a new use, challenging them to do what they need to do with less property or buildings? Why don’t you review the Grand list and research it to determine whether the City control over properties is increasing or decreasing and why? Those would be good facts. And we could thank you for that good work. As you advise others, “Demand full accountability as part of the annual report …” The fact human-services agencies get money from the State or Feds or foundations and because of their non-taxable status, it means instead of having a “government” building where the State may have to pay PILOT, the City gets NO funds as taxes or PILOT!!! Not their fault, but a clever way for different government levels to beggar this City. Those programs get many City services but not education because they have no children. Doesn’t some PILOT from them seem reasonable? Catholic Cathedrals or humble storefront churches, or Jewish temples or Muslim places for prayer are part of our infrastructure. More respectful research ought to be done on the subject of their part in municipal support.

Of course, it would be reasonable for them to ask about our budgets, spending patterns, and checks and balance mechanism, and what would we tell them? Time will tell.

Plain truth of the matter is we have an administration that devolves. A culture that regresses that precedes the current mayor also. GR mentioned the new public works facility. Good example on a large property that once housed Producto, a prosperous manufacturing firm, which was displaced, lost tax revenue, additional overhead. The City Hall Annex and McLevy Hall are also shining examples of ineptness. I just noticed another perfectly good building that is about to come down on State Street that has the name Hubbell on it. A perfectly good parking garage with perfectly good office space. They are probably demolishing it to escape the onerous tax assessment, and why wasn’t this used by the City for that Police Division for which the City is paying through the nose a couple of blocks away? This open space is good for the birds I guess, and by the way, you’ll never see people in those parks on the Pequonnock, other than some tacky ribbon cutting, for which they are now demolishing industrial buildings on the river, a wasted tax-generating opportunity and a wasted opportunity for small-business development. This all has a mafia type ring to it.

To lower our residential property property tax rate by a significant amount–say, by about 25% to about 30 mils–and to be able to fund our schools and municipal services at the same rate as Stamford’s (for example) we would need to grow our commercial tax base/grand list by 13+ BILLION dollars … I don’t think we have enough room in Bridgeport–even using park land–to accomplish that with Bass Pro Shop-type development (let alone create the 20,000+ living wage jobs we need on this development model).

To reiterate my last posting–

The reason why we don’t have any mil-rate-lowering, high-value tax base development is because Governor Malloy and Mayor Finch et al. are complicit in the plan to keep Bridgeport in place as the “servants’ quarters” for Stamford/the Gold Coast/suburbs. It is in the plan (“One Coast, One Future”) for us to host the social-services sector/criminal-justice services for Fairfield County. Therefore we get the jails, methadone clinics, etc., while Stamford gets the Bridgewaters and Charter Communications, along with $200 million of incentivizing “first-five” money from Hartford.

We could have high-value development here if the “right people” wanted it to be here. There are state and federal incentives, plus what we could come up with as city, to make it worthwhile, economically, to come to Bridgeport. Why is it we attract so many box stores, warehouses, waste storage/transfer depots, incinerators, power plants etc.? They all have to deal with our tax rate.

And, if the “right people” wanted us to have high-value, job intensive tax base, the local taxes on such establishments could be defrayed by way of many economic incentives related to enterprise zone employment, etc.

Bridgeport needs to start voting its self interest–at the local, state and federal levels. The November 6, NO! win tells us we can vote our way back to prosperity.

In the meantime, we shouldn’t even waste our precious space with Bass Pro Shop-type development.

Jeff,

If you need $13 billion take the People’s bank building at 850 Main Street evaluated at $43,001,600. That would be 300 such buildings. You also have to consider Bridgeport’s love of low-income housing and the expense associated with that. Here is the problem. You build one 1/2 million dollar house. You get ~$12K/year taxes and need to serve one husband, one wife, 2.3 kids, 2-3 trash cans, 2-3 toilets, 1-2 showers. Maybe a pool. Or, you build 10 $50K houses. You still get ~$12K in taxes but now you have 10 husbands, 10 wives, 23 kids, 20-30 trash cans and toilets, 10 showers and you need to provide the pool. It is just not economically feasible.

If you can raise the value of all the property in town by 20-25% the mil rate should drop by same. Then add high-value buildings and cut tax-free property. Sell parks and city property to whomever wants it for as much as you can get. Look at the schools that closed. They were ‘sold’ (really given away) to old folks homes, community centers and even schools. Now, the school was too old and run down to be a city school. So it was closed and sold to a company that made it a school??? How does that work??? You blame Stamford but it is really the people of BPT who demand low-income housing and such be attached to every project that happens in town. Look at the hotel project that was at Steele Point before Bass Pro.

Hey BOE we have a love of low-income housing because there is a need for it. What do you suppose we should do with the people who need this housing? I am sure the Mayor would love your idea since he seems to want the poor people driven out of Bridgeport.

You can buy a house right now in BPT for $40K. How many more low-income houses do you need? Here is what happens. Look into how many of the low-income houses are still owned by the original buyer.

1- A guy with a kid in BU or SHU realizes it is cheaper for his kid to buy the house and have a roomy who pays $2-300/mo than it is to live in the dorm. After the kid graduates the father keeps the house as a rental property.

2- A landlord buys the house in a tenant’s name. The tenant lives in the house until it can be transfered to the landlord.

3- Other various ripoffs were someone gets a cheap house and makes a lot of money at taxpayer expense.

BRG, you have to choose what you want. A lower mil rate or higher property values. The high mil rate is driving out business and wealthy property owners. It is just cheaper to live in Fairfield. Secondly, the unaffordable housing part of living in BPT is not the mortgage it is the taxes and schooling. If you bought a $175K house in BPT you would pay $600 taxes, $1000 private school, $1102 Principal&interest for a total of $2700/mo. That would buy you a $320K house in Fairfield. Assuming $623 taxes, $2129 PI and the Fairfield schools are acceptable to you. For a total of 2750/mo. I’m going to guess insurance is the same in both cities.

The dialogue between BOE and BRG is quite interesting to me. The facts, such as they are, for the most part are accurate: taxes are high, and property values are relatively low for City homes. Which is chicken and which is egg? And who are the “people of Bridgeport” and why do they come here to live?

Instead of a long essay today, let me suggest the Bridgeport Mayor look at his City side budget very closely this year before presenting it to the City Council. Will he be asking for 1%, 3% or 5% cutbacks in current budgets? Will he first eliminate the large number of “ghost positions” relative to the suburbs? Will he ask Sikorsky Airport manager to reduce expenses to the level of revenue, a balanced airport budget? Maybe he will even see some wisdom in TRANSPARENCY: make a list of all City properties, including all the new parks, etc. and let everyone know what is available for sale and at what value. What a concept. Level playing field!

Lower budget means less tax from residential and business property owners, a trend to be admired. Do it another year, and another, and it makes OPED job easier. If Mayor doesn’t work this way then City Council with final vote on budgets needs to get serious. Come to a B&A meeting and you can see what they think passes for serious or stewardship! Sad! City Council election comes about in 11 months. Get your scorecards out. First thing to do is learn the names of your representatives. See where they stood on the Charter Change, and other issues of importance to you. Time will tell.

*** They’re not here yet so let’s not count any tax dollars or new jobs yet! *** NOT BITING YET! ***

*** That snapper won’t be biting anytime soon! Also the deal is not signed in blood which means “anything” can happen, good or bad. Right now it’s just another name on the long-awaited Steel Point list that just keeps getting longer and longer, no? *** Extra, extra, read all about it! ***