Wall Street municipal bond rating favorability may not be sexy stories, but they save taxpayers millions of dollars.

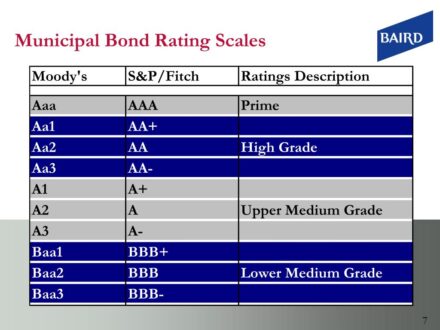

Two leading credit rating agencies S&P and Fitch have assigned Bridgeport A+ ratings, an “upper medium grade” that lowers the interest rate on financing capital improvements such as roads, bridges and buildings as well as refinancing debt service that saves additional dollars.

It’s been decades since the city achieved these ratings.

The S&P rating report declares, this “reflects our view of the City’s very consistent historical record of maintaining balanced operations and incrementally improving reserves for nearly a decade while navigating economic and state challenges.”

From Fitch: “The ‘A+’ IDR and GO bond rating reflect implementation of Fitch’s new “U.S. Public Finance Local Government Rating Criteria” and the city’s continued improvement to its unrestricted general fund reserve levels.”

What does this mean?

Wall Street is big on rainy day funds that pinch close to 10 percent bank reserves of the total operating budget. Example: if the operating budget is $600 million, that means $60 million in reserves.

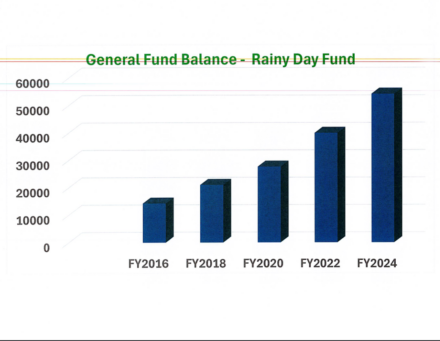

When Ganim returned to the mayoralty in December 2015, reserves were low, so too the city’s credit worthiness. The city has run surpluses that help build the rainy day fund to meet rating criteria. See chart below created by city’s Finance Office and validated by Wall Street review.

Wait a minute, you say, that $60 million in reserves can cut taxes! Sure, in the short term, then Wall Street lowers the rating leading to higher interest rates and tens of millions more to finance future budgets.

It’s like maxing out the credit card.

Fitch Ratings – New York – 13 Sep 2024: Fitch Ratings has assigned an ‘A+’ rating to the City of Bridgeport, CT $70,175,000 general obligation (GO) bonds, series 2024A.

The bonds are scheduled to sell via negotiation on Sept. 25. Proceeds of the bonds will be used to support various capital projects and refund a portion of the city’s outstanding GO bonds for debt service savings.

Fitch has also affirmed the following ratings for the city:

–Issuer Default Rating (IDR) at ‘A+’;

–Outstanding GO bonds at ‘A+’.

More from Fitch here

News release from mayor’s office:

The City of Bridgeport is pleased to announce that Standard and Poor’s (S&P) national rating agency has just raised the City’s financial credit rating to an A+ level. This rating upgrade follows credit rating upgrades by Fitch Investors Service and Moody’s in 2023. This is the first time in over thirty years that the City’s financial ratings have been raised to A+ by multiple national credit rating agencies.

In addition, the City also recently received a Certificate of Achievement for Financial Reporting from the national Government Finance Officers Association.

The S&P rating report states, this A+ rating “reflects our view of the City’s very consistent historical record of maintaining balanced operations and incrementally improving reserves for nearly a decade while navigating economic and state challenges.” S & P further states, “management has implemented proactive budget oversight to stay on a planned path to rebuild reserves.”

The Fitch rating report states, “The rating incorporates the City’s continued improvement to its unrestricted general fund reserve levels and the City’s financial resilience.”

The GFOA Award states, “This Certificate of Achievement is the highest form of recognition in governmental accounting and financial reporting, and its attainment represents a significant accomplishment by a government and its management.”

Based upon unaudited results as of June 30, 2024, the City is expecting to end the 2024 Fiscal Year with a general fund surplus, with overall Fund Balance “rainy day funds” projected to be about 8.5% of the annual budget as of June 30, 2024. The Fiscal Year 2025 Budget approved with a minimal 1% increase from the previous fiscal year. This adopted budget kept taxes stable, with no change, allowing lower interest rates along with the city refinancing to save City budgets over a million dollars over the next few years.

Mayor Ganim says, “We are so pleased by the City’s upgrades in national ratings and the recognition by credit rating agencies of the City’s good management work and solid financial results. For nearly a decade, the City has been able to manage a balanced budget while allowing us to hold the line on taxes each year. I want to thank all of our City officials, City Council, and Finance Director Ken Flatto for their efforts to attain these awards and recognitions.”

Finance Director Flatto added, “The City thanks all our departmental members for working so hard to achieve solid financial results and also thanks to our State delegation and state leaders for helping the City with enough state aid to help sustain essential service operations for citizens and schools.”

Thank you Ken Flatto!

Let me guess, John Stafstrom is still the Bond Counsel representing the City. When is Ken Flatto going to release the cost to the City or all fees and percentage paid to the Bond Counsel just during the last 10 years? Let me get a link to how well El Salvador is doing.

Appreciation for this signal of success from another rating agency regarding City fiscal matters is due. It takes years to dig out of a financial hole, and it is hard work without some luck involved as well as much silence about details and facts that depend on OPEN, ACCOUNTABLE, TRANSPARENT, and HONEST governance values in a municipality.

A+ as referenced in this article does not mean to Bridgeport taxpayers what it meant in our school days. Then, if you received such a grade on a test or at the end of a marking period, it indicated the teacher’s acknowledgement that you provided the best that could be expected. In this case it is merely a grade indicating that the fiscal balances are in line and well reported, not that what was purchased provided ‘best quality’ or that what was avoided by not spending was either ‘extra’ or ‘unnecessary’.

An A+ such as we have been awarded by S&P or Fitch does not comment on needed funding for City schools FROM THE CITY ITSELF. It is likely inadequate to maintain safe and secure physical environment or ‘best practice outcomes’ for youth in school. This A+ should look at the attention paid by City Council members to internally review land, buildings, and other property owned by the City and look for a PLAN, not an unspoken CONCEPT, of how they regularly provide current financial strength through sale or auction of City properties. What becomes of that money? Is it earmarked for specific use? Are results shared with the public?

How do citizen, voters, taxpayers, become a part of the fiscal process, invited to know more and contribute their observations? One example from downtown: I can enumerate as many as ten missing or broken parking meters within a dowtown square block. How long have surrounding meters been emptied of coins by department employees without notice of the potential dollars lost to the City by haphazard administration or inaction in this regard? Does this support lower taxes and improved ratings from agencies? Time will tell.